2022 RECAP & LOOKING AHEAD

- 2022 Trends: Chasing Precision with ‘Science’

- Record IPOs Email Promotions, Unsustainable Growth

- Investing to Improve our Processes

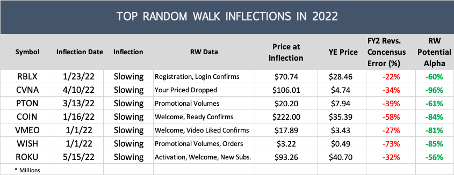

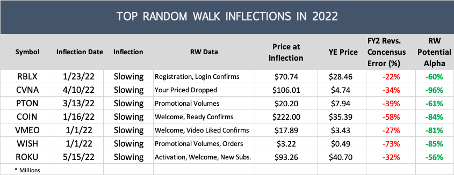

- Inflections: Select Winners and Losers

- Goals for 2023

2022 RECAP & LOOKING AHEAD

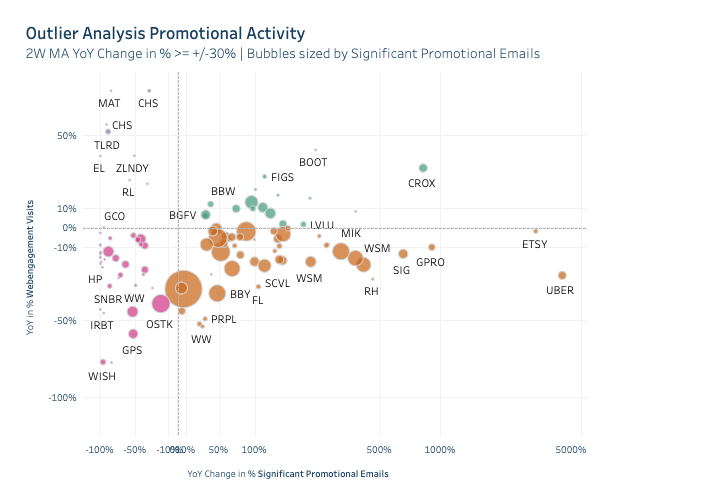

Our promotional ensemble identified the biggest outliers of the period from several weeks before Black Friday through Cyber Week for our investor partners.

Standouts with previously unseen promotions, largest risers in discount campaigns, or those with robust organic demand that were able to reduce email volumes include:

AEO, COUR, CROX, CURV, GME, HIBB, LOVE, PVH, NKE, RH, SCVL, SONO, TPX, TSCO, URBN, VFC

Our email intelligence systems have been capturing tracking and classifying emails from leading brand for nearly 7 years providing the most robust, quantitative insight into email promotional activity. i

The quickest and cheapest method for management to respond to demand inflections is to adjust its cadence and intensity of email discounts.

AMERICAN EAGLE OUTFITTERS (AEO) Both total promotional email volume and significant discounts nearly 30% lower than a year ago.

GAMESTOP (GME) Meteoric rise in BF related promotional activity with “$50 off x box” and “up to 60% off video games”.

HELLO FRESH (HLFF) Total promotional email volumes up nearly 300% driven by “$180 off Thanksgiving” and “get up to 70% off” discounts.

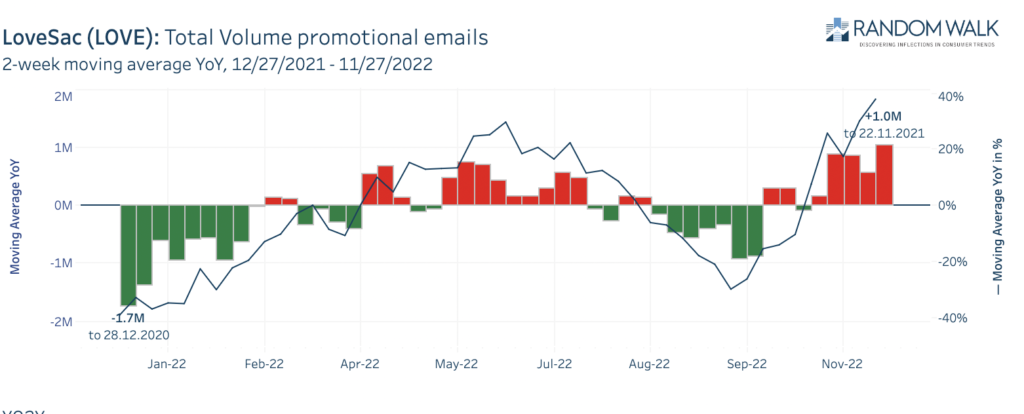

LOVESAC (LOVE) Steeper than year ago and higher volume significant discounts driven by “35% off Bundles”.

NIKE (NKE) Sequential and YoY declines in steep and significant discounts

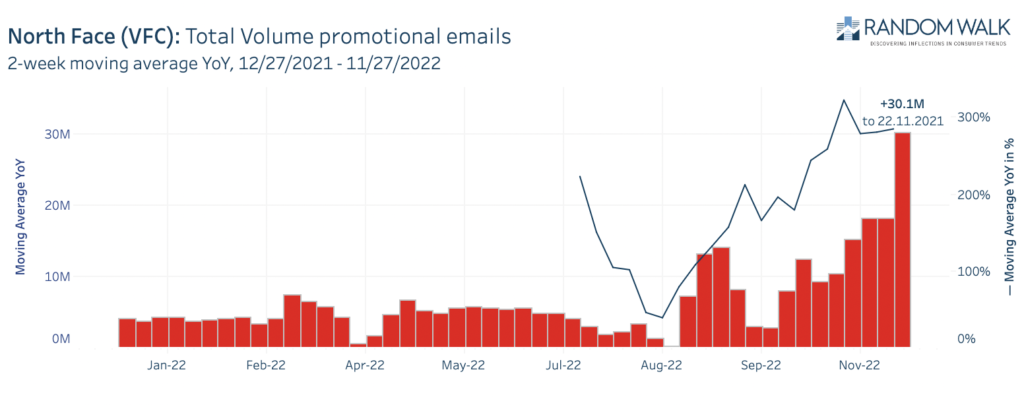

VF CORP (VFC) Both North Face and Vans saw sharp rises in all categories of email promotions. Total inbox volumes, significant discounts, steep discounts and storewide promotions all rose to record highs.

contact us for to see the entire Holiday Promotional Outlier List

Random Walk Email Intelligence has never identified more unusual promotional activity than over the past 30 days. In June alone our systems have captured nearly 100 never seen before campaigns as consumer preferences shift.

HOME FURNISHING PROMOTIONS ACCELERATE TO NEW HIGHS

BIG, LOVE, W, WSM

In home furnishings our data indicates COVID pulled forward, not just several quarters but year’s worth of demand. Now, with the backyard, garage space and wallets maxed out, consumers are shifting away from creating the perfect Instagram worthy at-home backyard oasis.

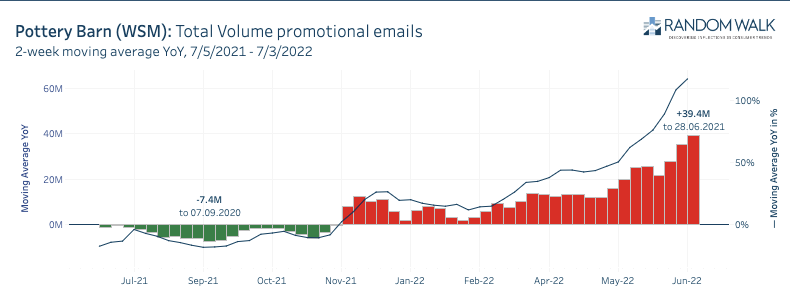

Random Walk Email Intelligence indicates record growth the discount campaigns in Q2 from Pottery Barn.

DEMAND FOR CASUAL ‘AT HOME’ FOOTWEAR FADING?

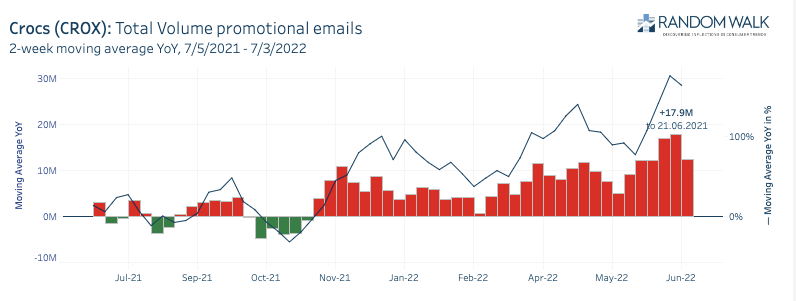

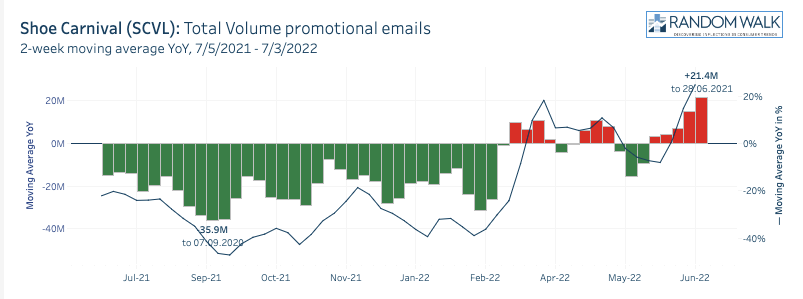

CROX, FL, SCVL

During COVID, Americans gobbled up footwear for the outdoors or comfort around the house casual footwear retailers benefitted and throttled back promotions. However, this summer with consumers more spartan due to gas prices and $20 hamburgers they don’t appear to need so many sandals.

Crocs and Crocs retailers such as Foot Locker and Shoe Carnival have been blasting an all-time high volume of Croc’s specific discounts.

GET OUTDOORS ON THE ROAD MEETS $6 GAS

CWH, WGO, YETI

Without COVID checks, a free pass from work, and with $6 gas it appears road trip RV, van and mega SUV trips could be stalling. Our email intelligence has tracked growth in promotional volumes for outdoor camping accessory related businesses such as Camping World, Winnebago, and Yeti.

Into summer camping season Camping World has blasted out an all-time high volume of significant and steep discounts.

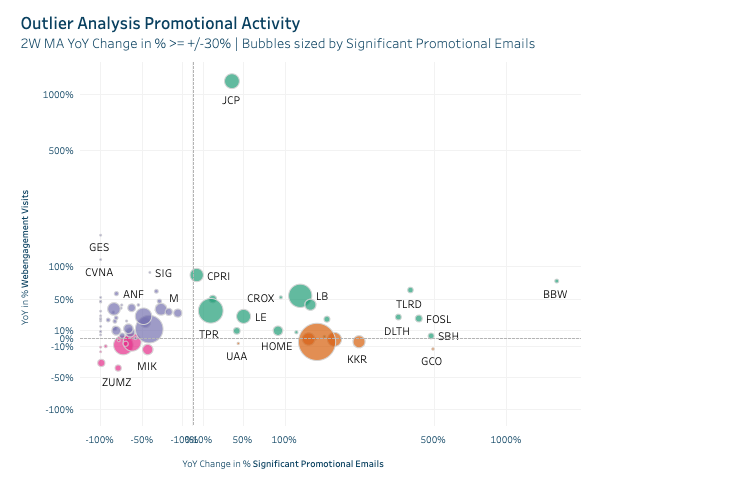

Our data visualizations allow quick identification of outliers within a specific sector. Find out which brands are losing organic demand and responding with increased “push” discounting campaigns to their leads

Download the pdfhttps://ranwalk.com

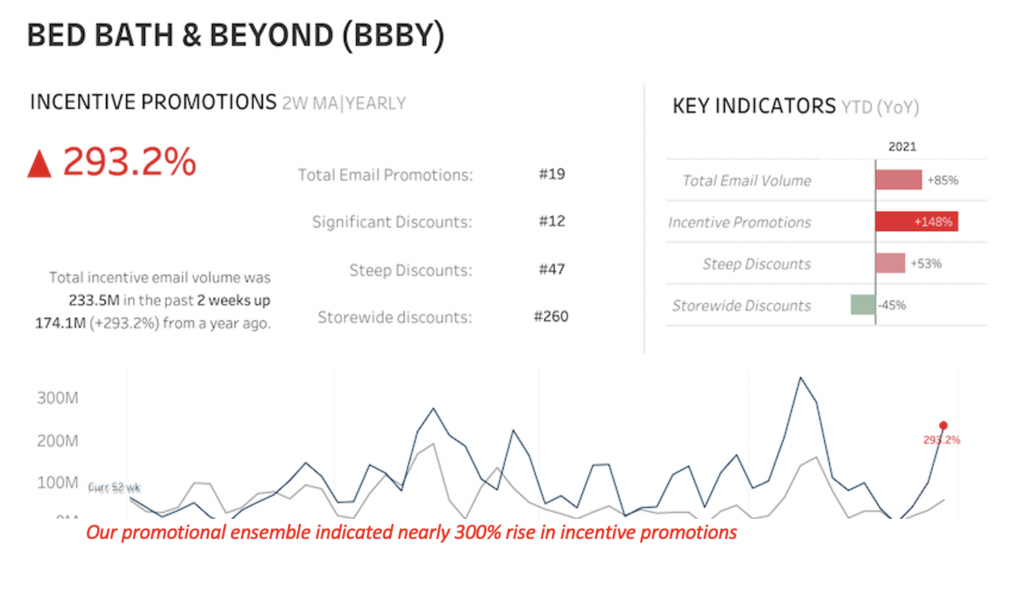

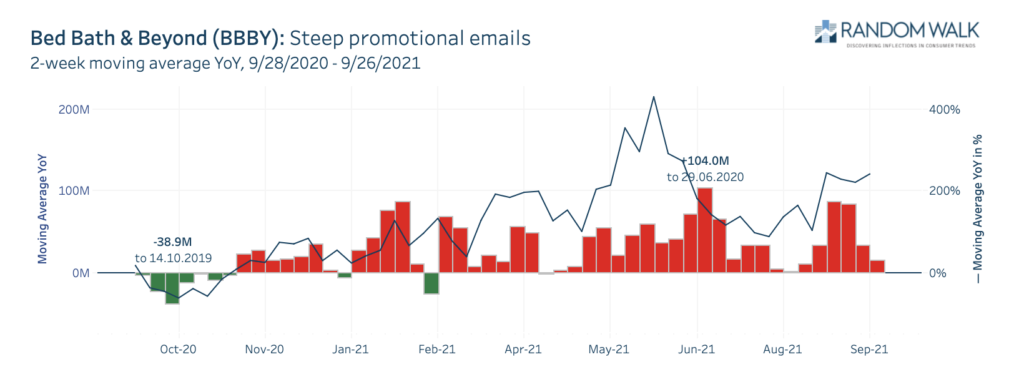

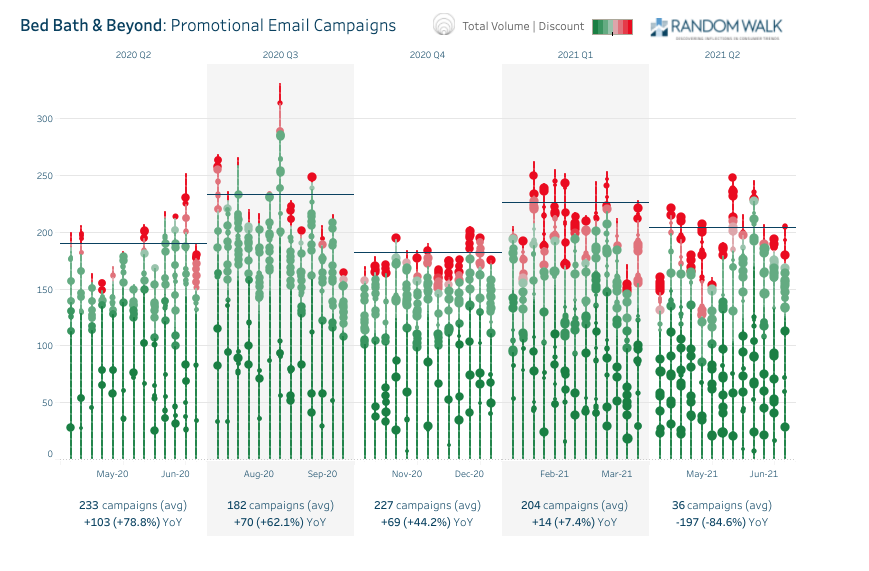

While most “home” related retailers were reducing their promotional campaigns and email sending volumes due to strong demand and supply chain constraints BBBY’s was doing the opposite. For much of 2021 Bed Bath and Beyond crafted the narrative of a revamped, growing e-commerce platform and a turnaround with new in-house products. While management sold the turnaround tale, our email intelligence detected they were ramping up “push” email offers to all-time highs in the face of stalling organic demand. With a long history of blasting out never ending 20% off coupons, our systems tracked an increase in the maximum discount implied and more frequent pushing of the same offers to leads.

The Random Walk Promotional Ensemble enables investors to quickly compare email discount campaign cadence on weekly basis with prior periods. As seen below both total promotional emails as well as our significant incentives category have been tracking at higher levels than any period over the past 3 years.

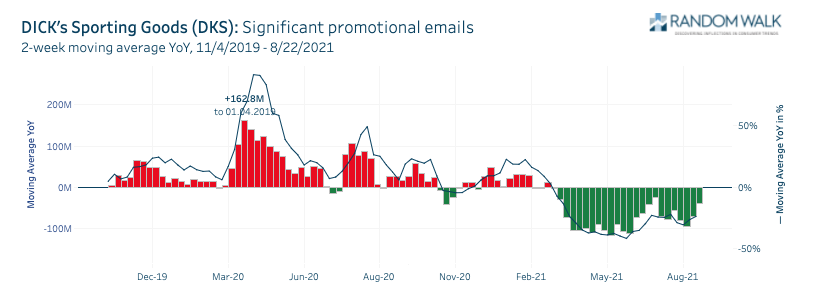

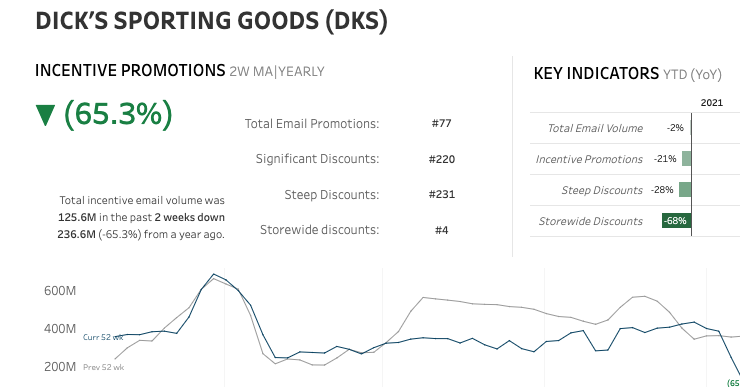

For Dick’s Sporting Goods (DKS) our promotional ensemble revealed the opposite situation as Bed Bath. As demand for sporting goods and a return to youth team sports accelerated this summer, DKS dramatically reduced nearly every form of promotion. Our systems tracked a 65% reduction in incentive promotions.

In both BBBY and DKS. investors focused on proxying revenues with expensive transactional failed to capture the extent of the inflections.

BBBY missed revenues by 3% with revenue guidance just 2% below expectations. The explosive 300% growth in promotional activity provided a clearer picture of the dramatic decline in organic demand consistent with the 25% drop in share price that ensued.

For DKS, while revenues did blast by consensus, our ensemble correctly tracked higher merchandize margins translating to bottom line improvements with a blowout $2 earnings beat and a 25% increase in earnings guidance for the year.

The newly launched Random Walk promotional index data product provides the most robust quantitative view of promotional cadence available. Uncover demand changes as management responds to them weekly.

With more than 6 years of historical data tracking email promotional activity from nearly 300 consumer brands we are excited to launch our first data product!

This fall select clients can access structured weekly data for this first time.

Investors will be able to quantify and help answer the following:

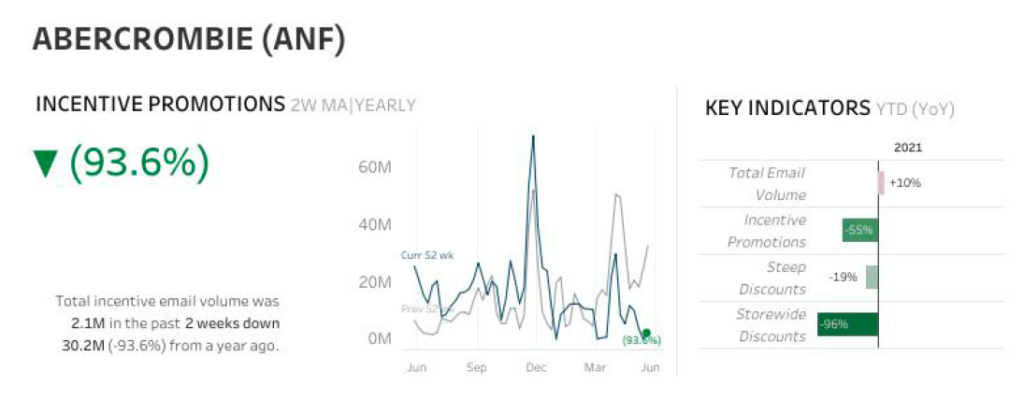

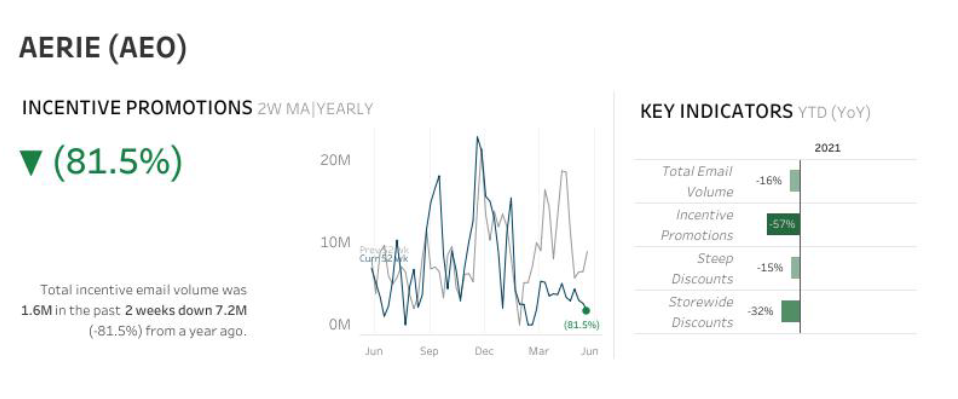

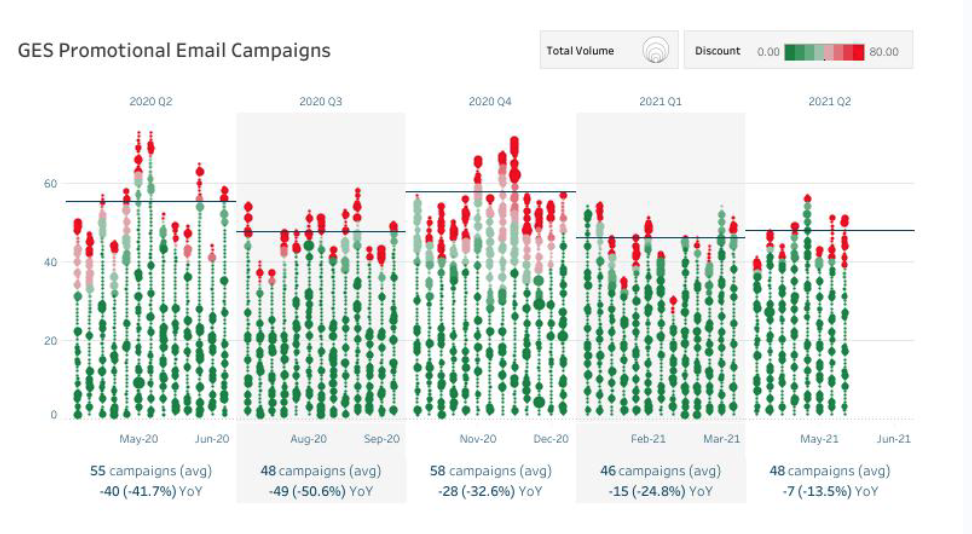

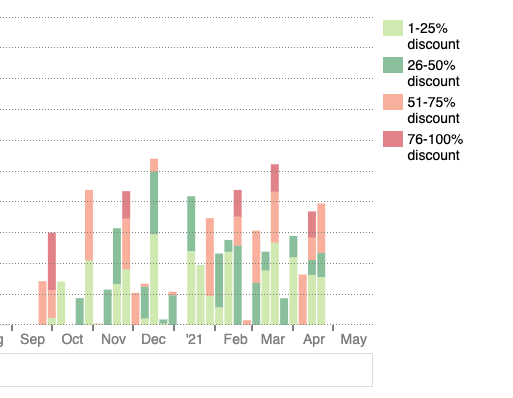

Our promotional email ensemble helped investors better understand and quantify the magnitude of changes in the intensity and aggressiveness that apparel brands such as Abercrombie & Fitch (ANF), American Eagle (AE) and Guess (GES) are sending. As weather has warmed, our promotional ensemble reveals robust demand growth as consumers previously stuck at home load up on “going out” summer apparel.

Our promotional ensemble quantifies the changes such as key declines in the volume of email campaigns, the distribution discounts offered.

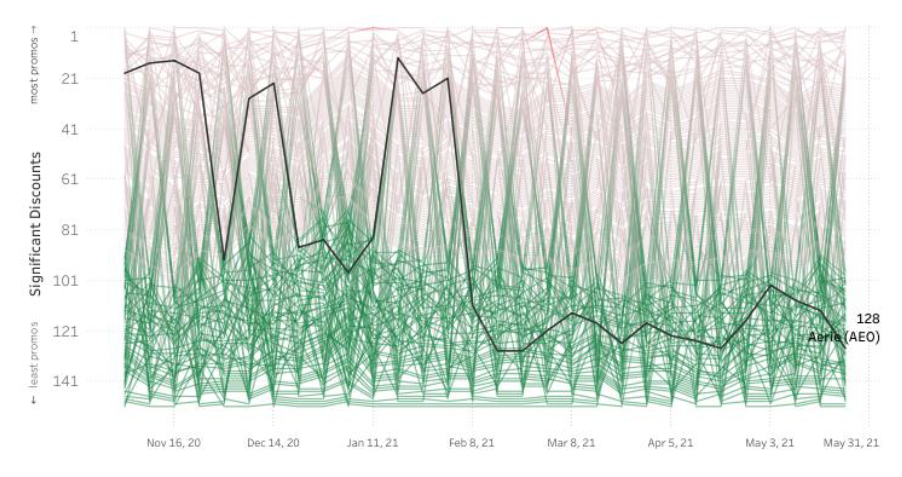

Successfully channelling rebounding demand for swimwear, AEO’s Aerie has further throttled back its promotions.

Our tracking on an sector basis reveals AEO has become one of the least aggressive promotors compared with its peers compared with just a year ago.

For Guess, our email intelligence allows investors to quantify the exact campaign frequency and intensity. As can be seen below, Guess is pushing out significant promotions and discount coupons much less frequently than a year ago as organic demand has rebounded.

Our email intelligence uncovered a subtle, but critical change in the email sending patterns of EBAY.

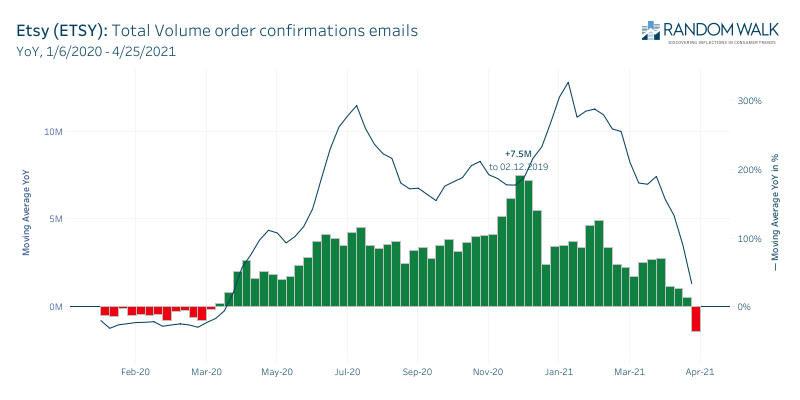

During COVID as demand had risen to unprecedented levels, EBAY throttled back the frequency and intensity of their email campaigns and discounting. However, this March our proprietary systems detected a reversal, with EBAY ramping up a specific type of email campaign containing discounting language unseen before. As management began to see COVID demand wane, they began using steeper promotional language in specific product categories. We identified this and warned our clients. In ETSY our tracking of order confirmation volumes showed a significant sequential slowdown in April.

Our ensemble has detected incredible, all-time high demand for car rentals(CAR) this spring as locked up Americans return to travel. This has resulted in less time and interest than a year ago for stocking up the home on small electronics(BBY), home décor (BBBY, ETSY), at home fitness (NLS).

AEO, CWH ELY, LE, NLS, PTON, SEAS, SEAS

To start April our email intelligence is indicating potentially significant changes in consumer shopping behavior. Temperatures are warming, and coincident with a COVID positivity rate in California sinking to 1.5% the state is relaxing restrictions and Americans are looking to get out.

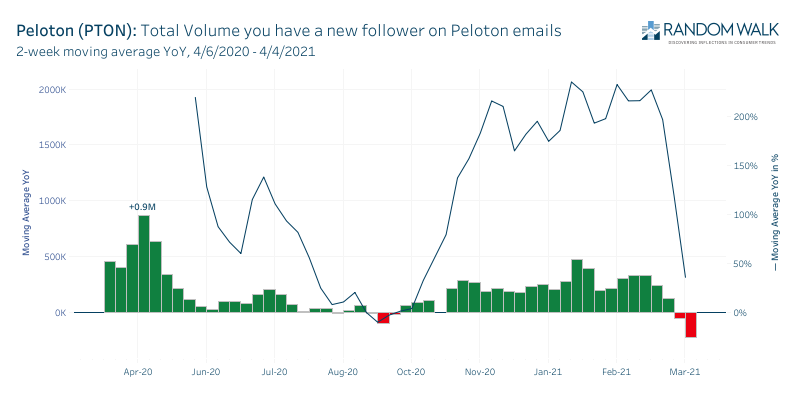

Our ensemble indicates sharp decelerations in ‘garage’ fitness equipment such as Bowflex, Nautilus and even Peloton. Have we finally maxed out our kettlebell collections? Our email intelligence tracking various order confirmations shows volumes near 6 month lows.

On the positive side, our email intelligence tracking ticket confirmations indicates the broader reopening of Sea World and Magic Mountain has generated explosive demand in getting out to the theme parks.

Our ‘Spotlight’ report focuses on identifying the bullish combination of declining promotional email activity coupled with rising organic online traffic. The names with the biggest strength share a common threat of getting outside. These include: AEO’s swimsuit line Aerie, ELY and Calloway’s new ‘Epic’ drivers and irons, LE with Land’s End outerwear and swim and CWH camping gear.

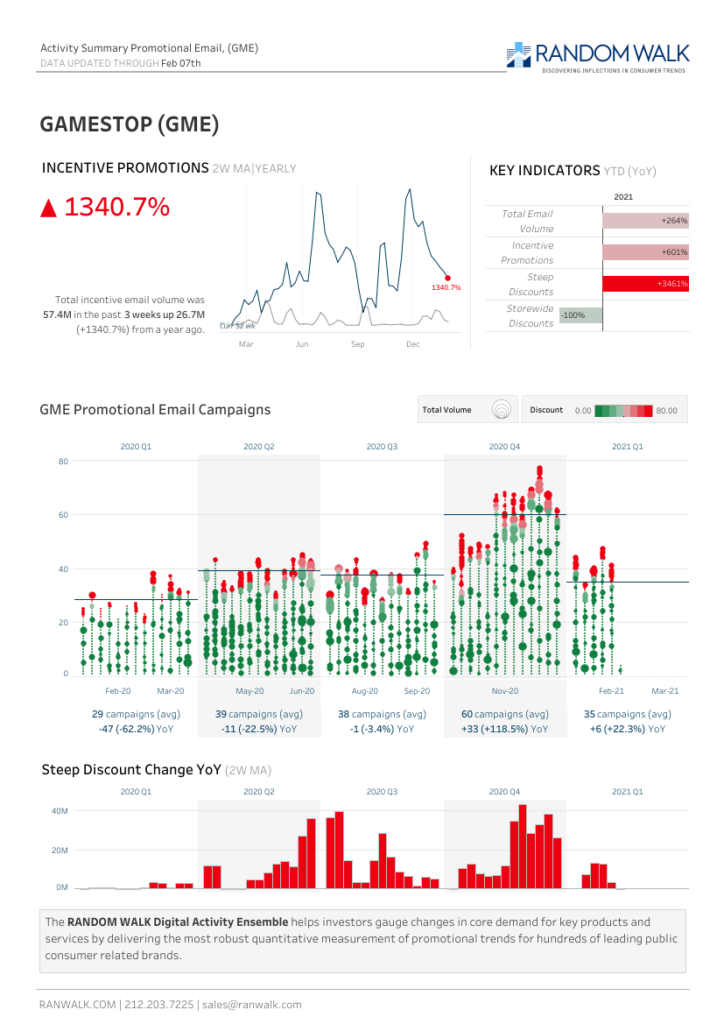

In the COVID era Americans are spending more time indoors hovering over their laptops, ipads, iphones looking for entertainment. With only so much Netflix (NFLX) content available for binging, consumers are ramping their COD, GTA and other gaming activity. The recent Reddit GME casino hysteria perhaps the most intense form of “online gaming” seen in history.

Using our proprietary email intelligence, we investigated whether there was any evidence of actual demand increases for the stale brick and mortars dinosaur GameStop.

Below our promotional ensemble quantifies exactly how desperate GameStop was in attempting to generate sales surrounding the critical holiday period. Compared with a year ago incentive email offers have risen an astounding 1300%. Also alarming, is our classification has tagged substantially more steep discounts than a year ago. Upon closer inspection these are from increasing coupons such as “up to 50% off games”, “$40 off used games”. Increasing discounts for core product offering bode poorly for demand.

Often times with the focus on online, management teams are shifting sales from in-store to online in an effort to show evolution. However, our promotional data reveals much of this increased e-commerce activity is from pushing out steep , never seen before discounts to their existing customer base.

Tracking New Customer Acquisition: 2020 was our most successful year in uncovering demand changes undetected by ‘big data’ credit card and transactional sellers. As COVID forced Americans inside, consumers discovered existing virtual solutions were superior to legacy in person dependent platforms.

For Docusign (DOCU), Fiverr (FVRR), Upwork (UPWK), Wix (WIX) our email intelligence captured exponential explosive growth in new customer acquisitions a full quarter ahead of pricy ‘big data’ transactional providers. By focusing on unique leading indicators such as “Welcome to Docusign” and “Your Wix site is published” instead of chasing coincident revenue proxies such as receipts we provided our investor subscriber parters a big jump on their competition. Docusign (DOCU) shares have appreciated more than 150% since growth in consumers receiving these confirmations triggered our identification in MARCH. Similarly, our methodology identified Upwork(UPWK) to start May with shares quadrupling.

If consumer preferences changes again as Americans leave their homes our investor partners will be the first to know.