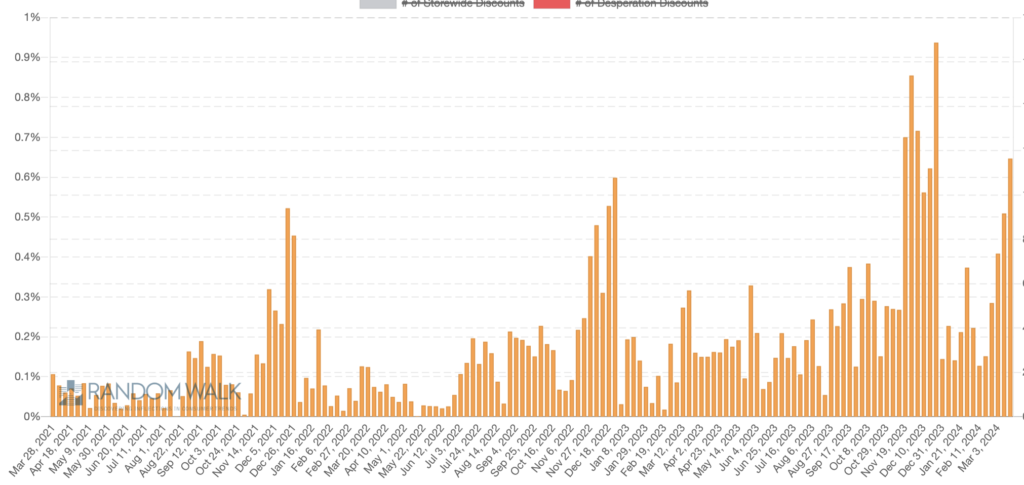

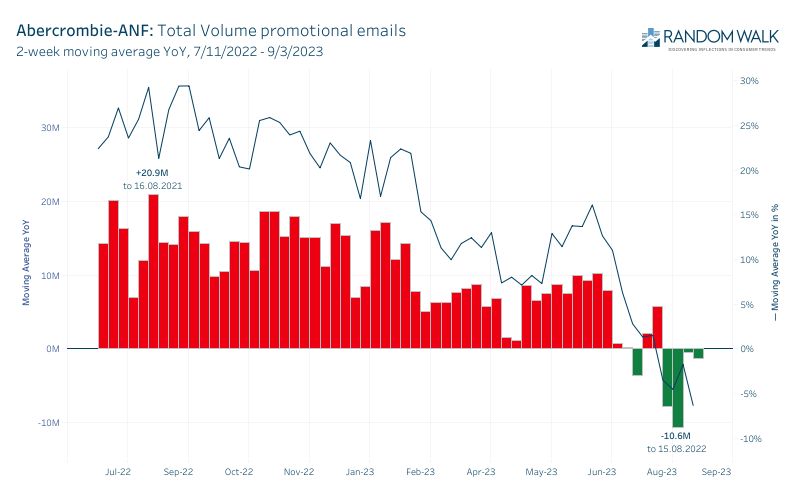

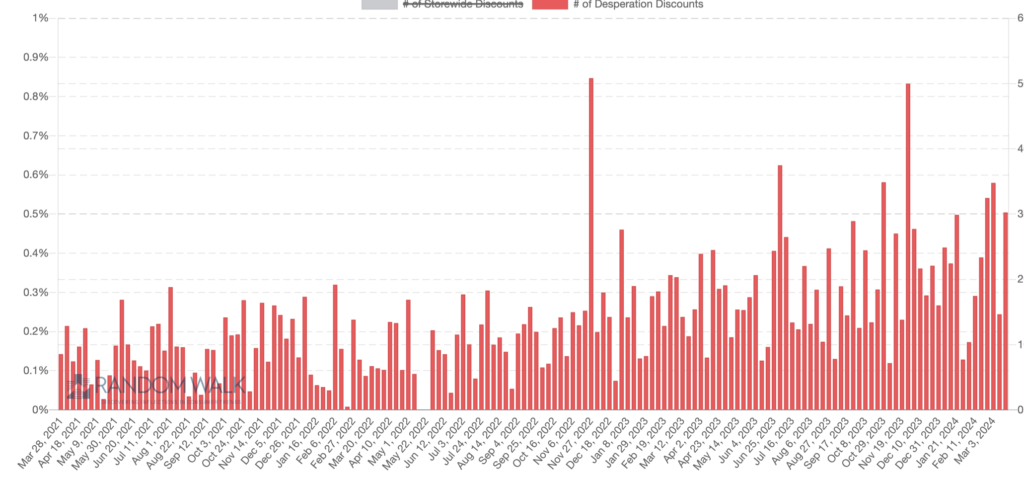

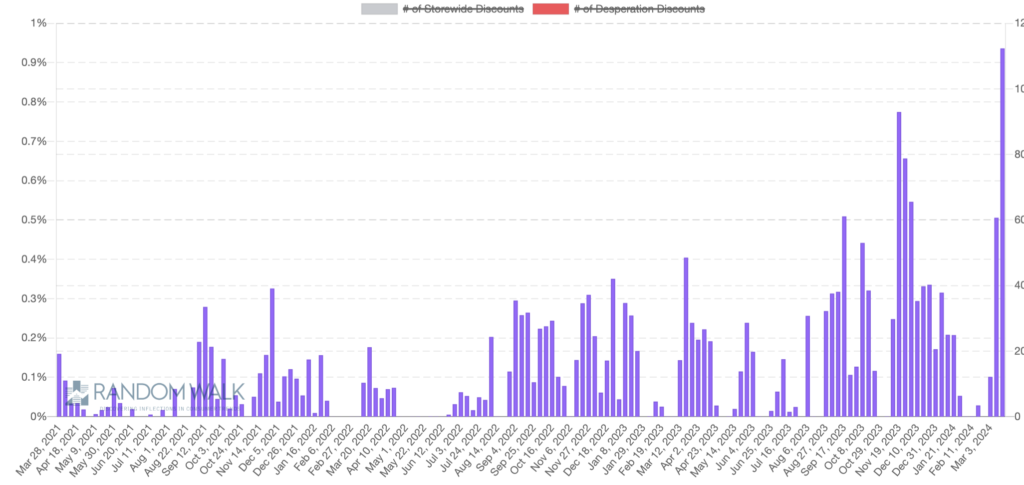

Acceleration in nearly every promotiponal email index conveys a change in strategy. Ulta appears increasingly reliant compared to past periods on ‘push’ discounts to beauty shoppers.

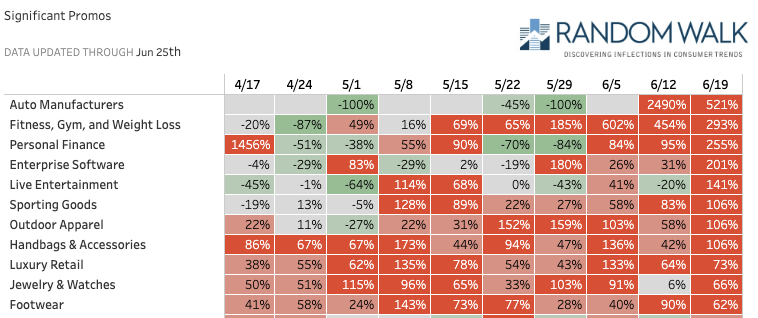

Random Walk Desperation Index, Steep Discount Index and Significant Discount Index are all either approaching or setting new highs this Spring.

New campaigns attempting to drive online engagement and conversion include:

“Open this email for FREE gifts and 50% off”

“FREE 4PC MAC Gift”

“FREE 17 PIECE SET”

Desperation Index. Our new desperation index tracks growth in certain keywords within email campaigns such as “extended”, “free shipping”, “urgent” and “one more day” to name a few.

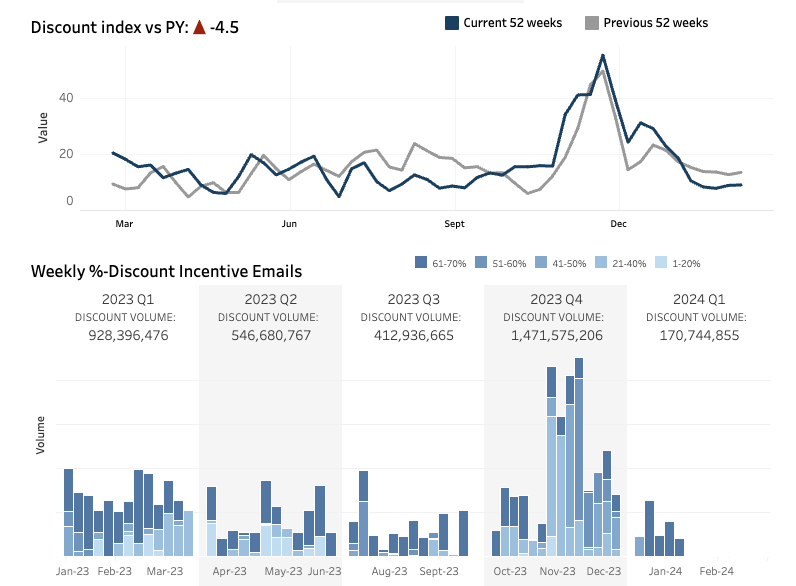

Steep Discount Index Our systems classify any coupon with an implied discount 40% off or steeper as steep. Recently Ulta has used much more 50% off language.

Significant Discount Volumes Our significant discount index tracking any coupon impacting the price has also shown acceleration beyond seasonal norms.