COVID Masks and Crafts vs. Feeding the Family

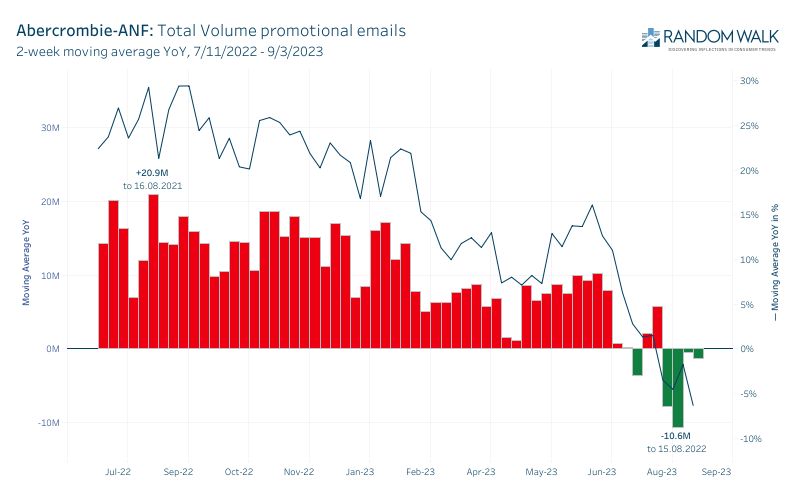

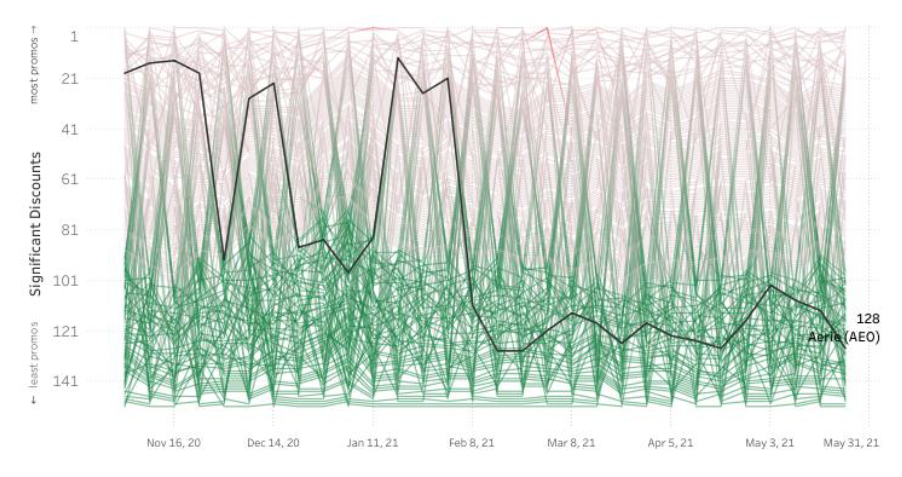

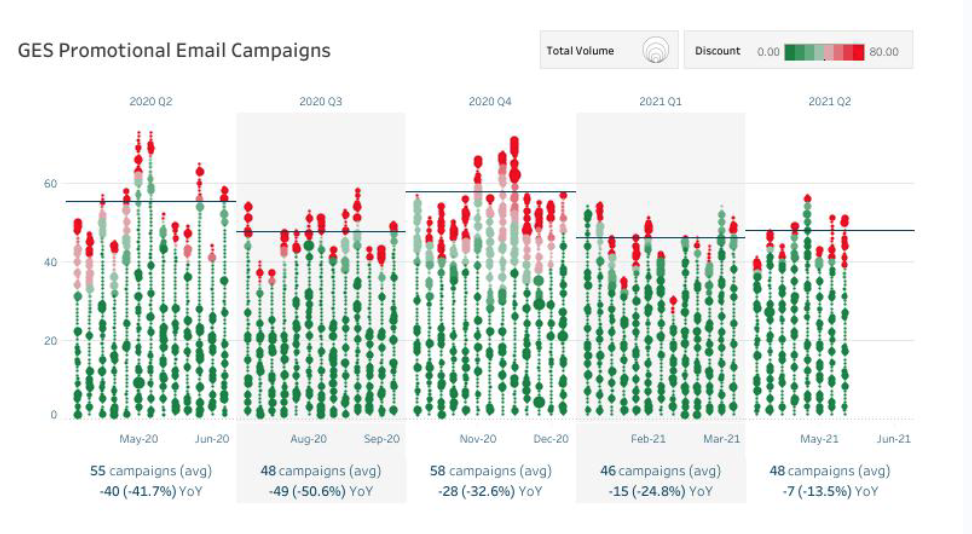

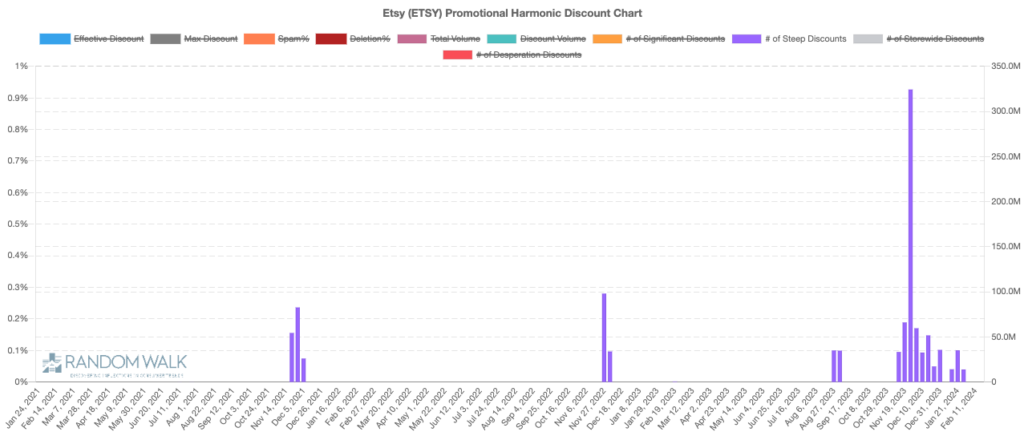

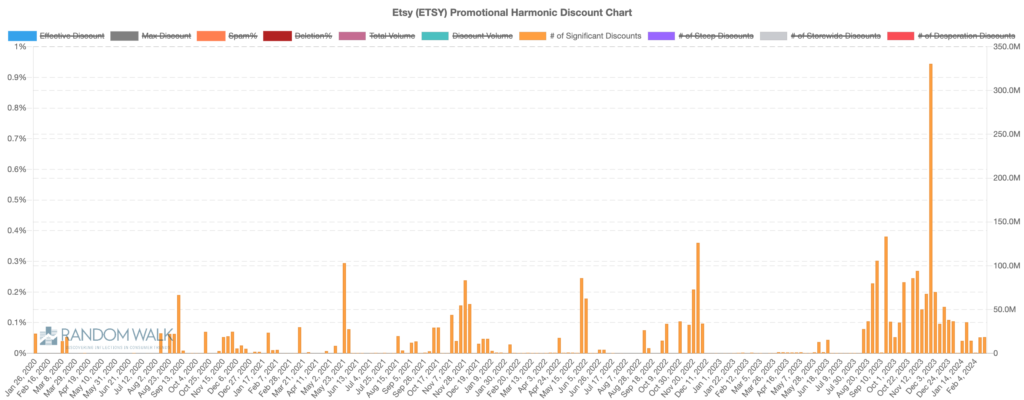

ETSY: Ensemble revealed new discount campaigns ahead of reduced outlook.

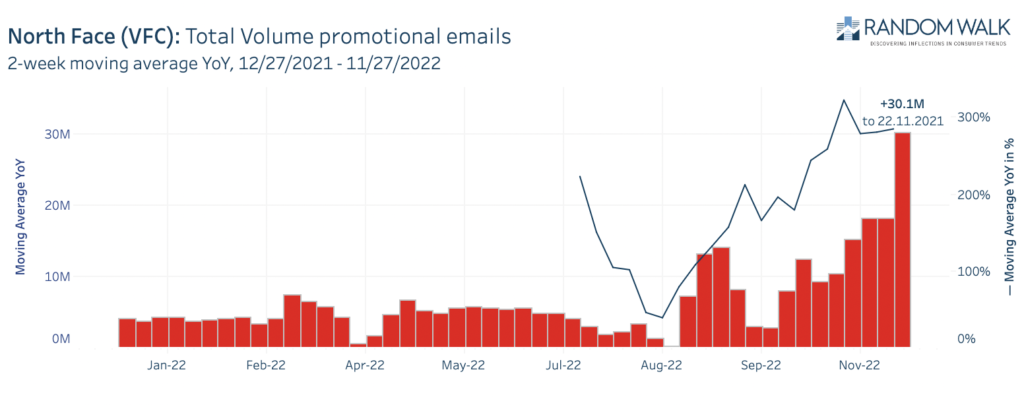

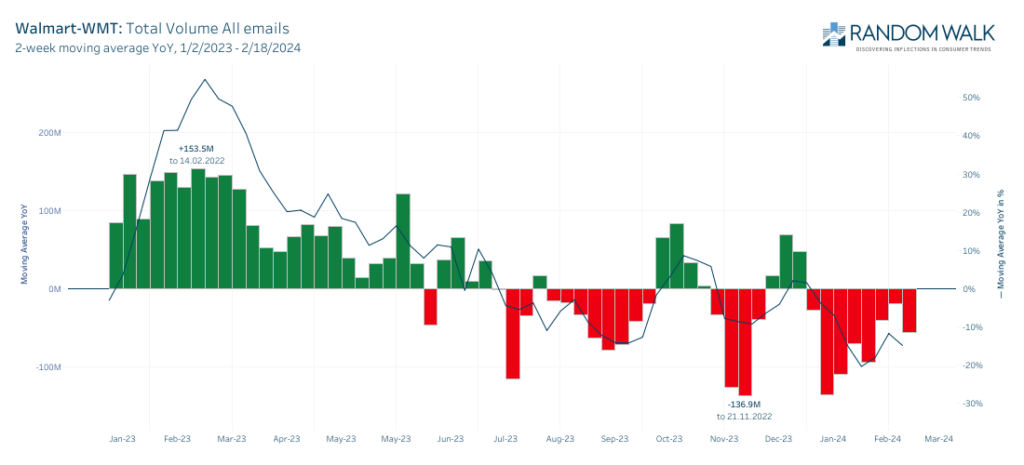

WMT: Ensemble tracked fewer email campaigns, and declining promotional discounts before improved inventory position and strong outlook.

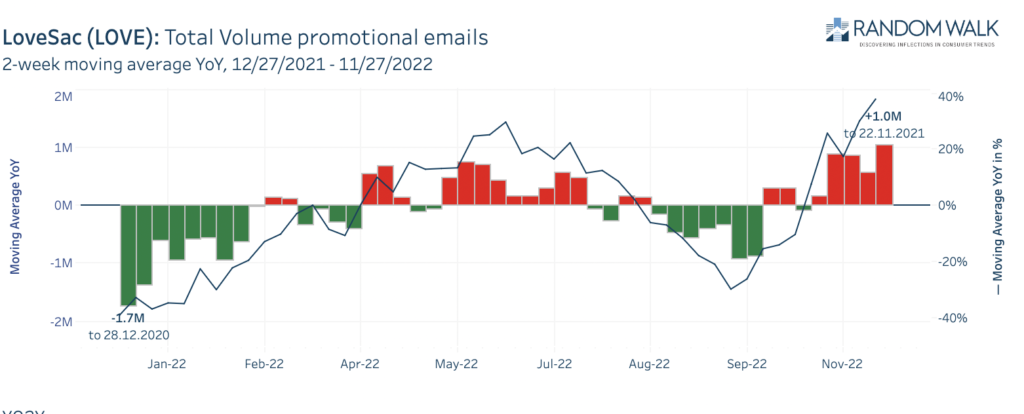

While our competitors focus on precisely tracking revenues our promotional ensemble provides a more predictive gauge of organic demand. Our technology can uncover changes in how brands communicate with customers and leads.

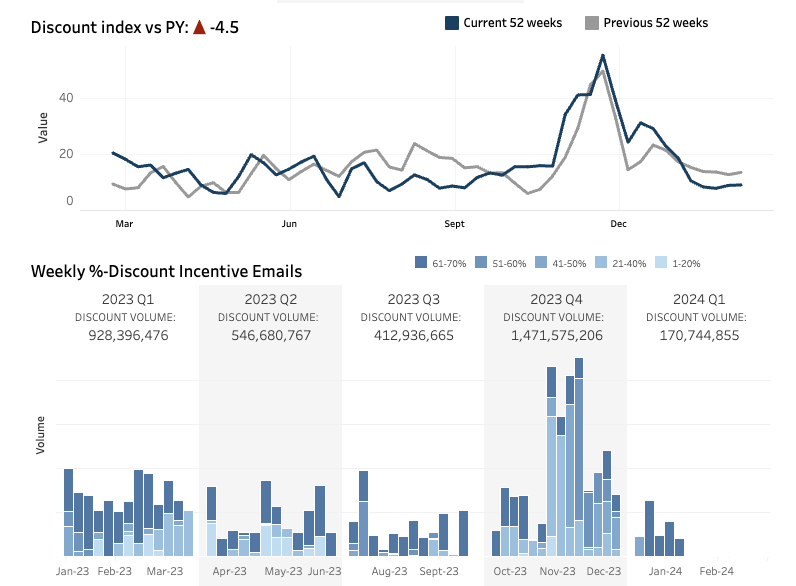

With the holidays in the rear-view mirror, it appears demand receded, and management responded by ramping up the implied discount language in emails. We captured more campaigns using 40% off language for specific categories. These campaigns and language had never been used before.

Persistent declining sales for the mature marketplace provides clues that consumer preferences have shifted. Gone are the lockdown and stimulus-related tailwinds driving interest in at-home crafts, masks mini calendars, dog sweaters, cute cocktails mixology and other unessential at-home items.

As food costs have spiraled out of control consumers have shifted to the perceived value provided by Walmart.

Wall Street’s ‘silo’ style of coverage creates the opportunity as one analyst covers ‘internet’ with Etsy and entirely different team covers consumer staples and Walmart. Both are now technology companies. Our sector agnostic data driven approach makes it easy to compare the two. As seen in our composite, Walmart is clearly responding to improved inventory levels and robust demand by reducing their email campaigns and discounts