PROMOTIONAL EMAIL ENSEMBLE DETECS INFLECTIONS IN BBBY, DKS

OCTOBER 2021 UPDATE

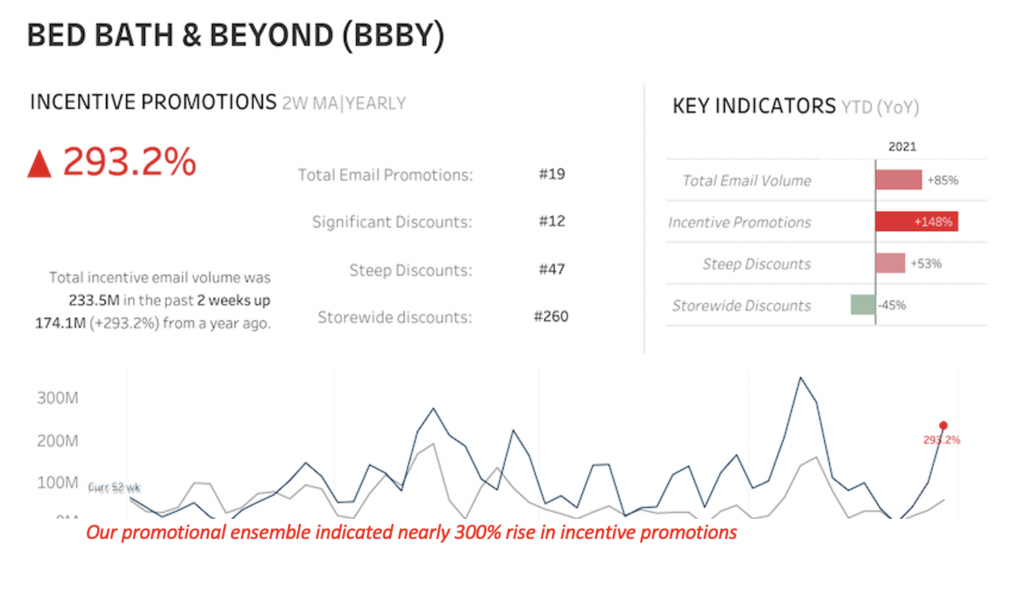

Bed Bath & Beyond (BBBY) Our system uncovers steep discounts, increased promotional campaigns, revealingly tepid demand foretelling, reduced earnings, guidance.

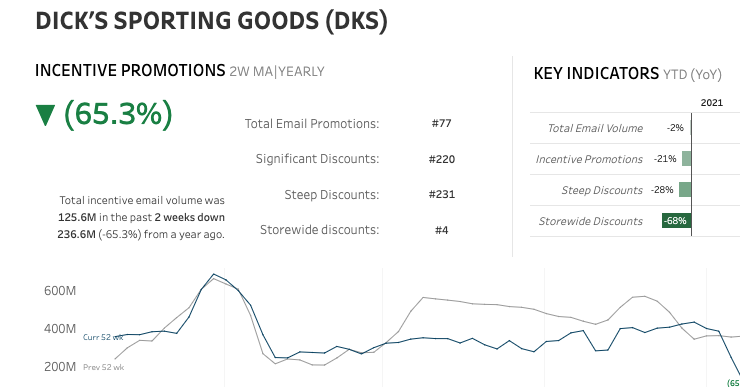

Dicks Sporting Goods (DKS) Promotional ensemble captured reduced significant incentive emails, steep discounts, translating into continued robust revenue growth, improved margins.

Promotional Index Our first data product has launched providing the most robust and quantitative view of nearly 300 brands promotional cadence dating back 4 years.

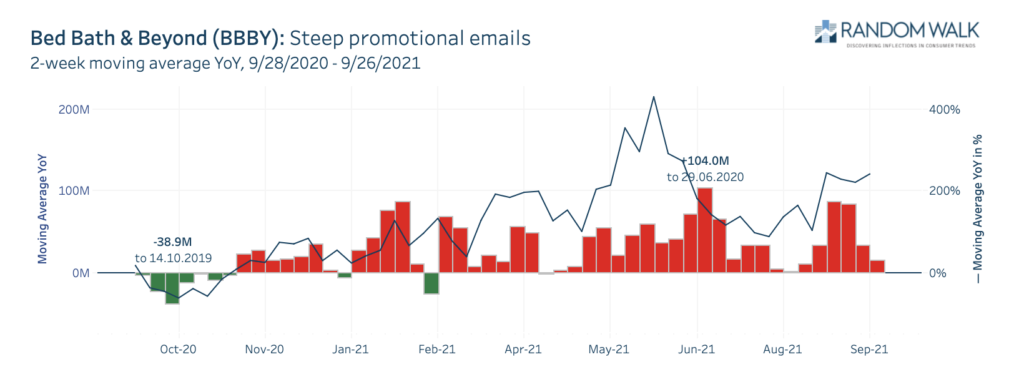

While most “home” related retailers were reducing their promotional campaigns and email sending volumes due to strong demand and supply chain constraints BBBY’s was doing the opposite. For much of 2021 Bed Bath and Beyond crafted the narrative of a revamped, growing e-commerce platform and a turnaround with new in-house products. While management sold the turnaround tale, our email intelligence detected they were ramping up “push” email offers to all-time highs in the face of stalling organic demand. With a long history of blasting out never ending 20% off coupons, our systems tracked an increase in the maximum discount implied and more frequent pushing of the same offers to leads.

The Random Walk Promotional Ensemble enables investors to quickly compare email discount campaign cadence on weekly basis with prior periods. As seen below both total promotional emails as well as our significant incentives category have been tracking at higher levels than any period over the past 3 years.

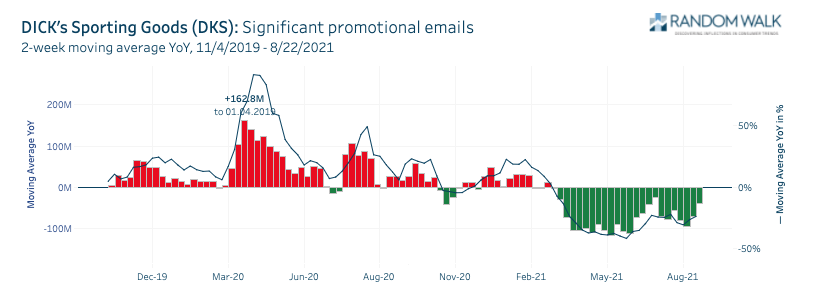

For Dick’s Sporting Goods (DKS) our promotional ensemble revealed the opposite situation as Bed Bath. As demand for sporting goods and a return to youth team sports accelerated this summer, DKS dramatically reduced nearly every form of promotion. Our systems tracked a 65% reduction in incentive promotions.

In both BBBY and DKS. investors focused on proxying revenues with expensive transactional failed to capture the extent of the inflections.

BBBY missed revenues by 3% with revenue guidance just 2% below expectations. The explosive 300% growth in promotional activity provided a clearer picture of the dramatic decline in organic demand consistent with the 25% drop in share price that ensued.

For DKS, while revenues did blast by consensus, our ensemble correctly tracked higher merchandize margins translating to bottom line improvements with a blowout $2 earnings beat and a 25% increase in earnings guidance for the year.

The newly launched Random Walk promotional index data product provides the most robust quantitative view of promotional cadence available. Uncover demand changes as management responds to them weekly.

Share :