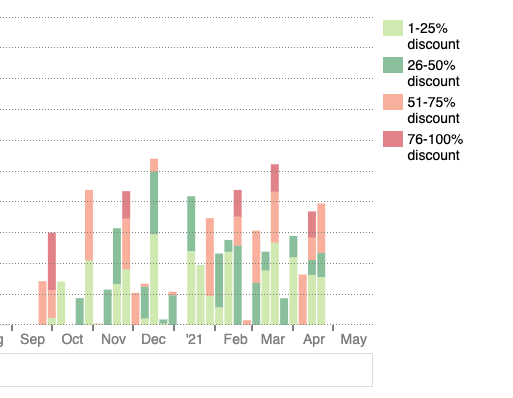

Our email intelligence uncovered a subtle, but critical change in the email sending patterns of EBAY.

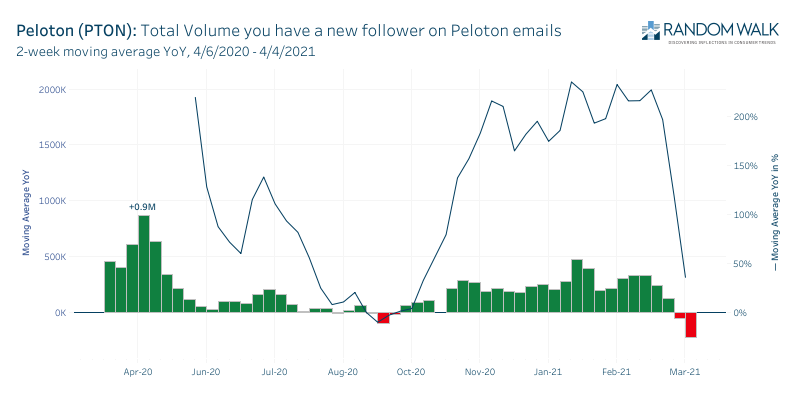

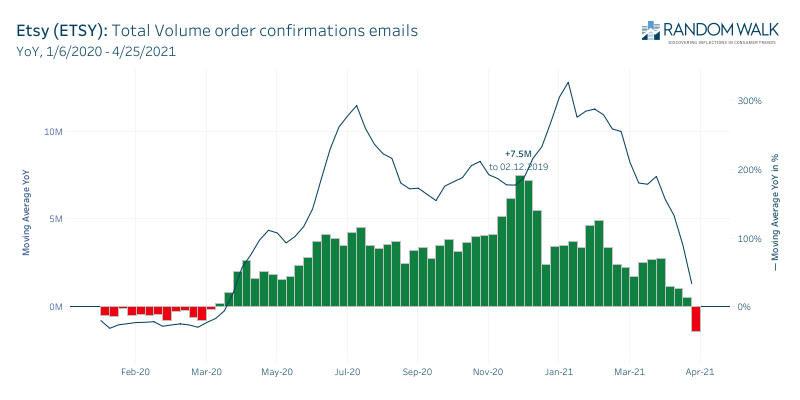

During COVID as demand had risen to unprecedented levels, EBAY throttled back the frequency and intensity of their email campaigns and discounting. However, this March our proprietary systems detected a reversal, with EBAY ramping up a specific type of email campaign containing discounting language unseen before. As management began to see COVID demand wane, they began using steeper promotional language in specific product categories. We identified this and warned our clients. In ETSY our tracking of order confirmation volumes showed a significant sequential slowdown in April.

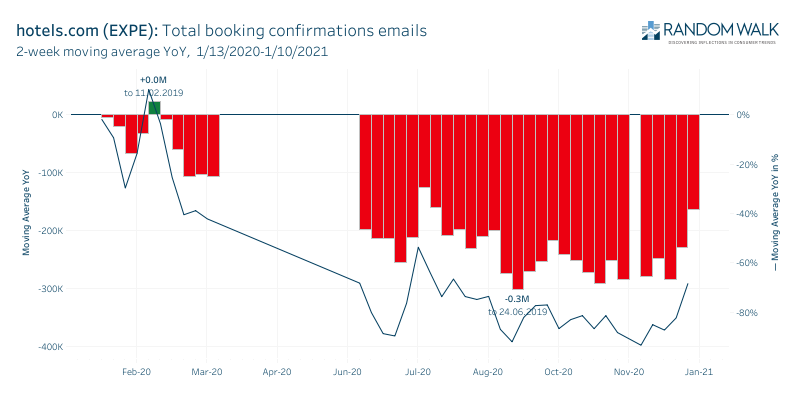

Our ensemble has detected incredible, all-time high demand for car rentals(CAR) this spring as locked up Americans return to travel. This has resulted in less time and interest than a year ago for stocking up the home on small electronics(BBY), home décor (BBBY, ETSY), at home fitness (NLS).