DATA DRIVEN INSIGHTS

Uncover Inflections

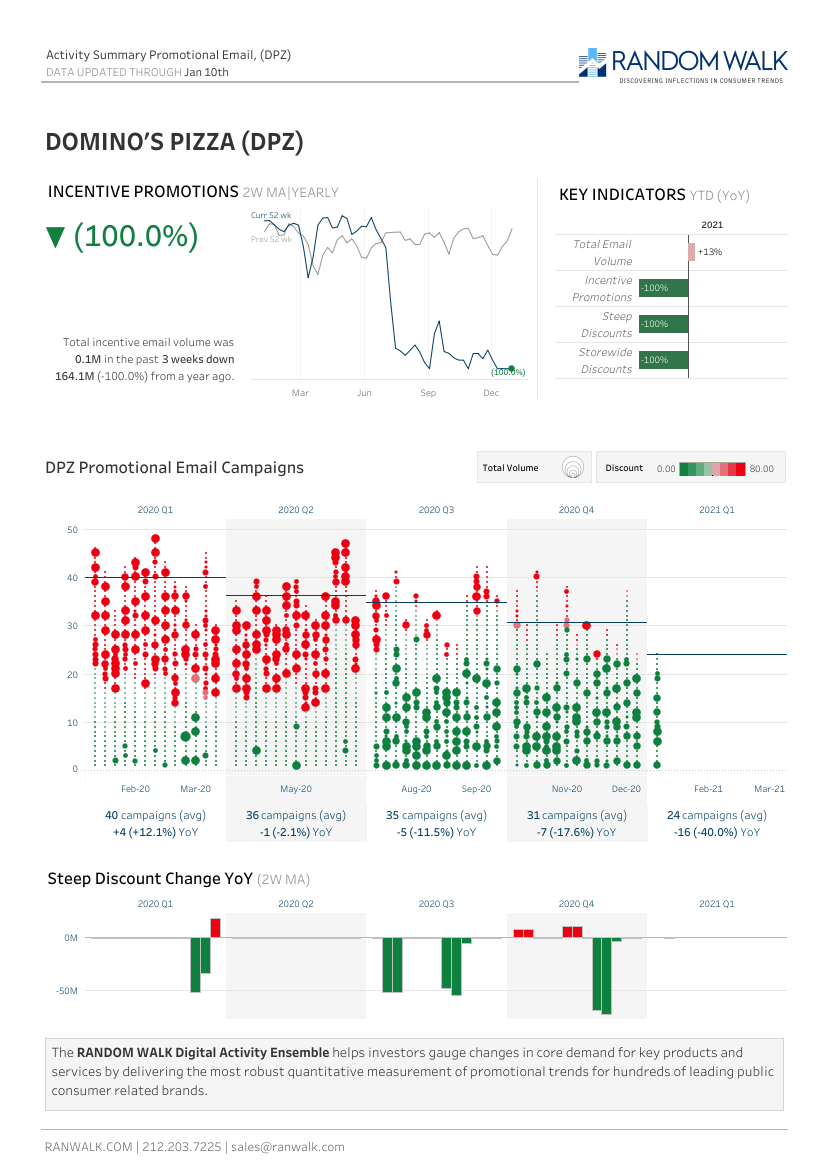

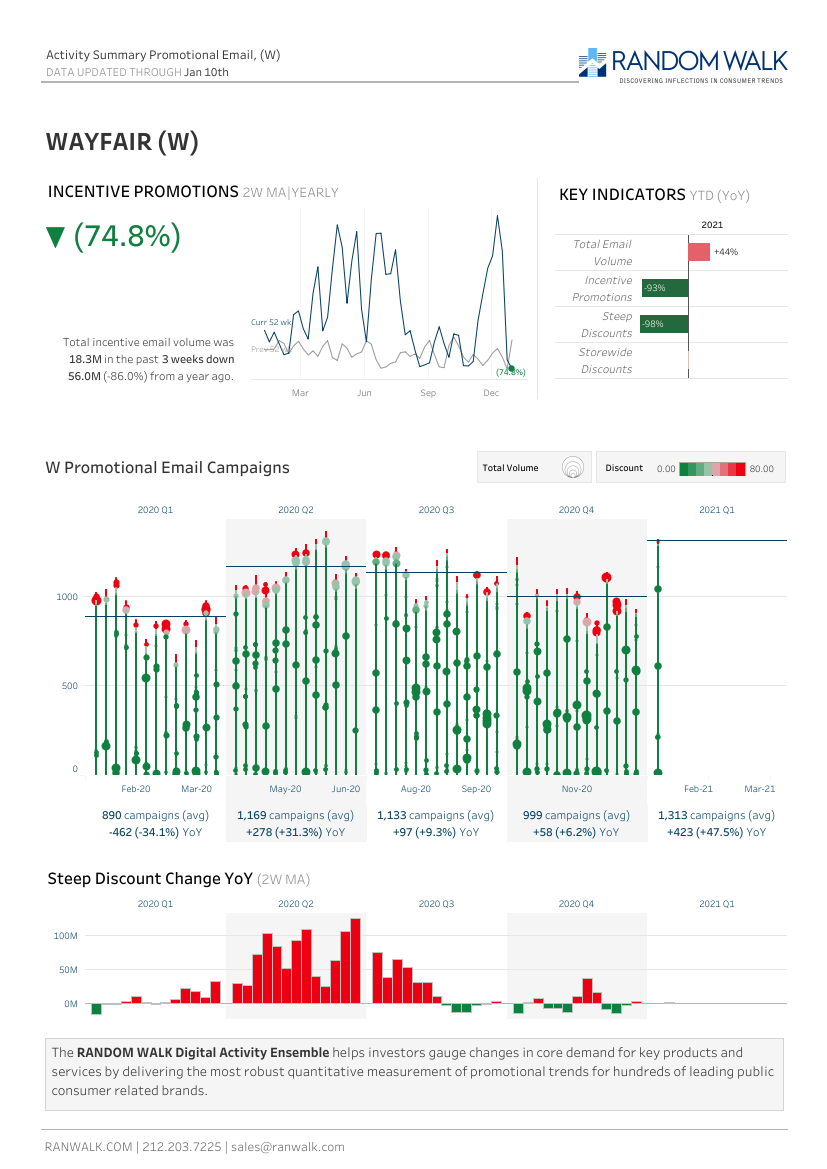

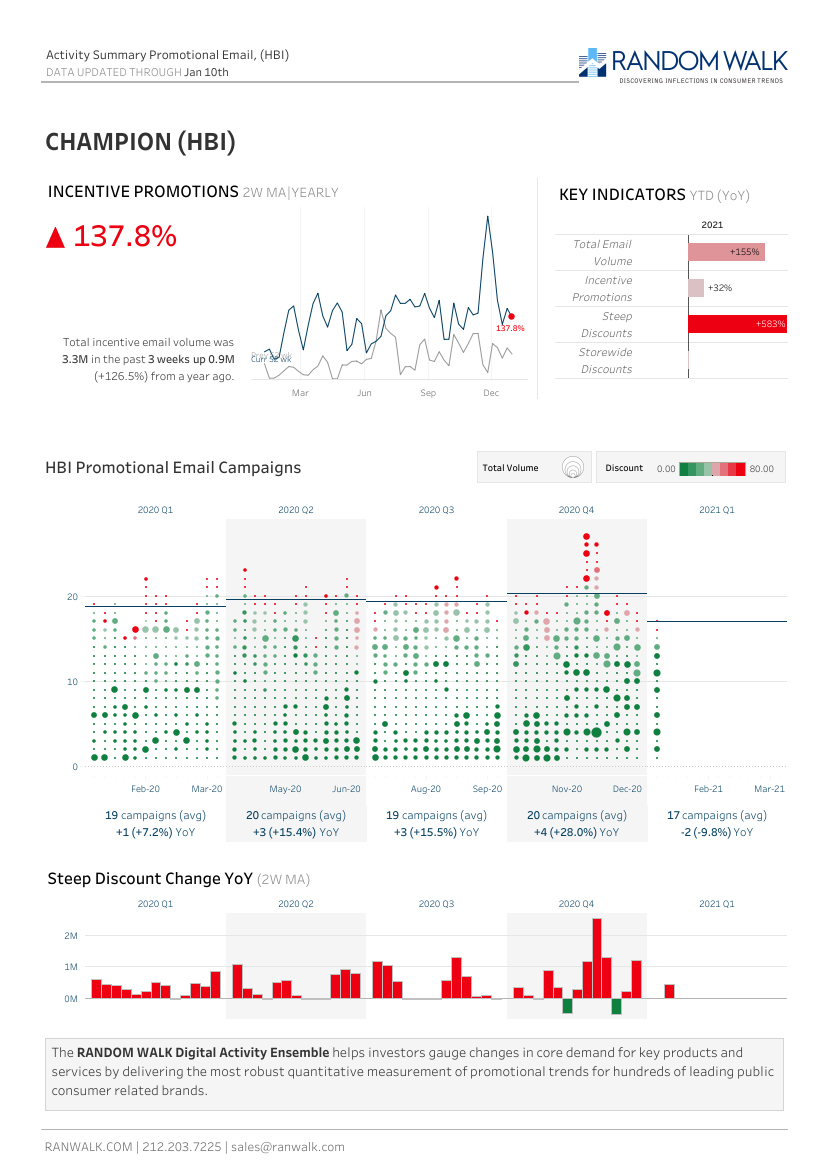

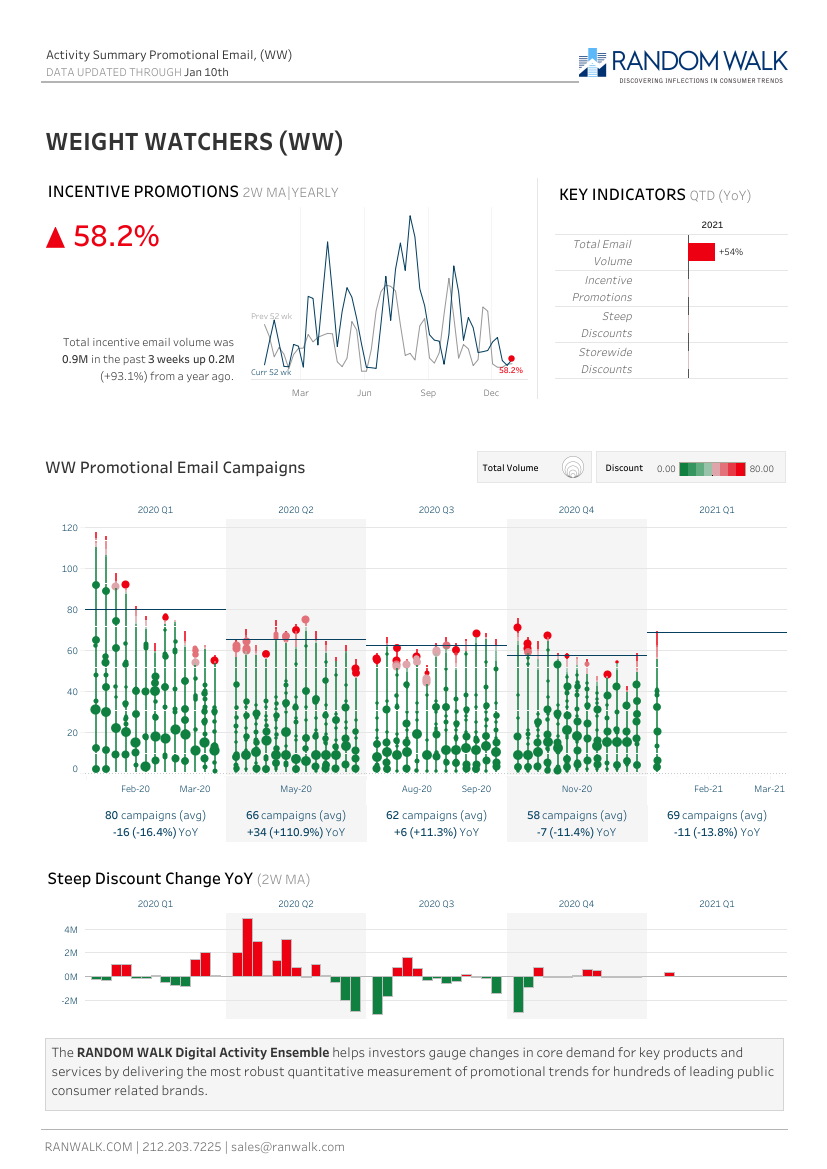

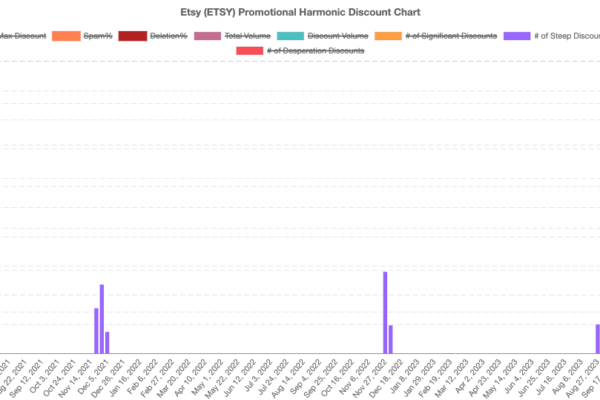

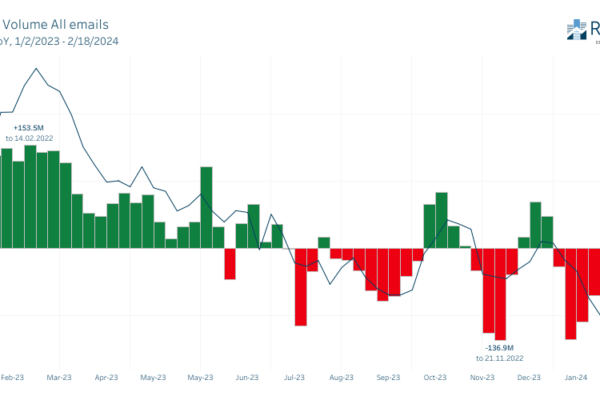

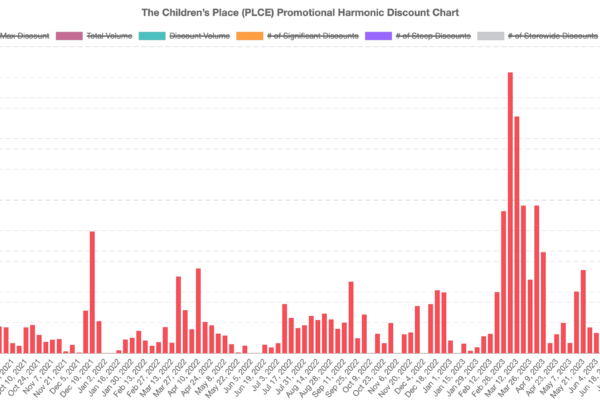

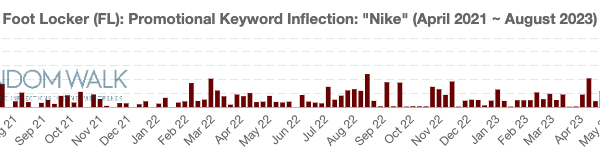

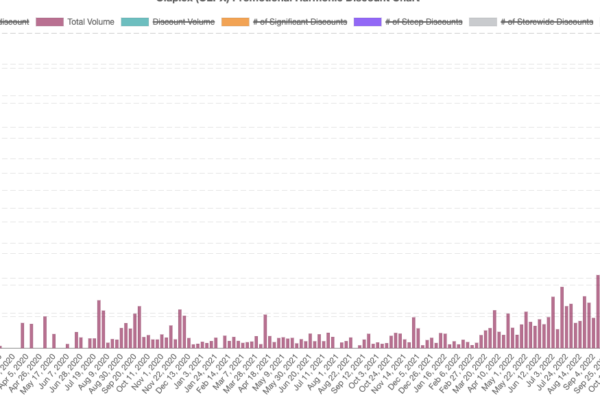

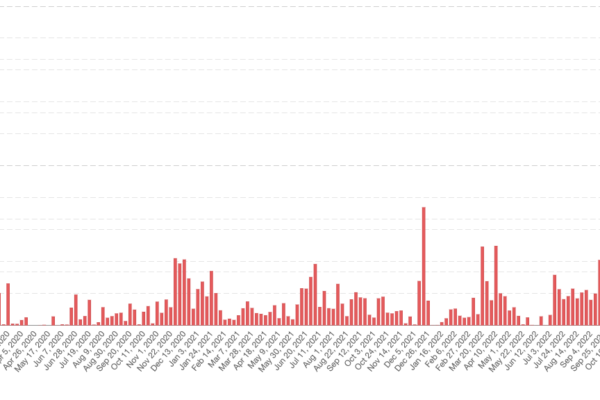

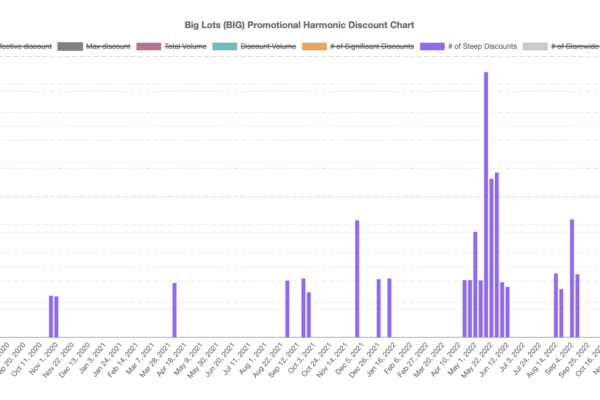

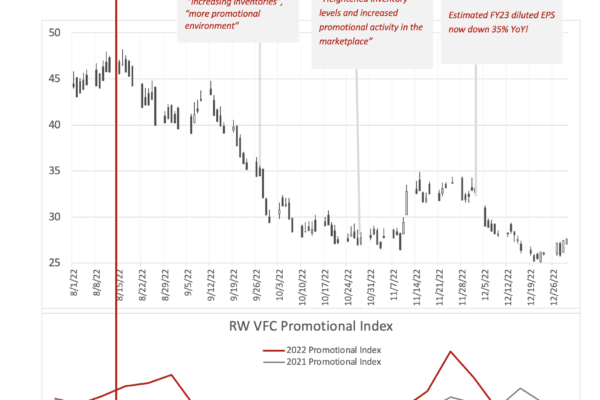

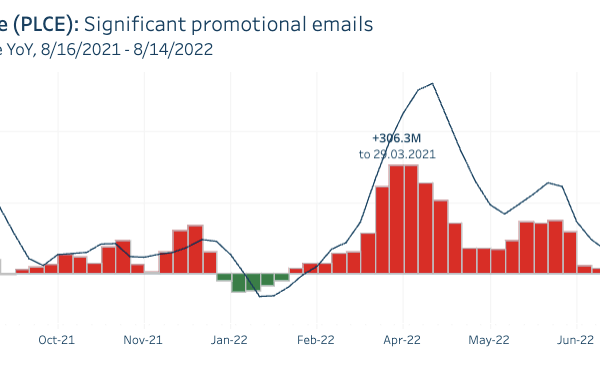

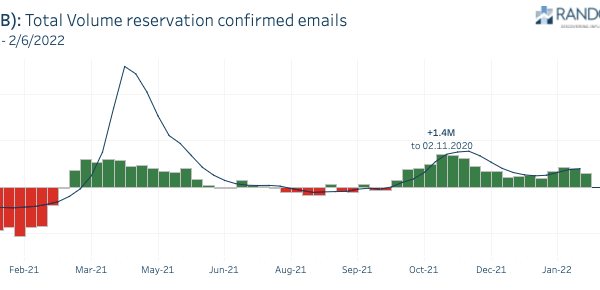

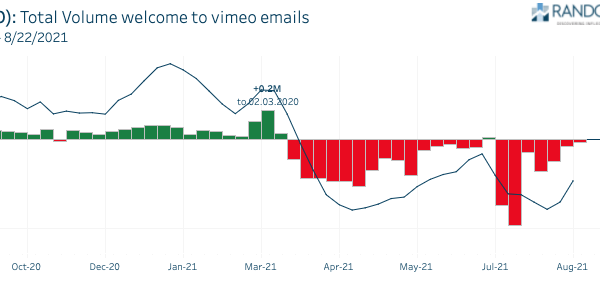

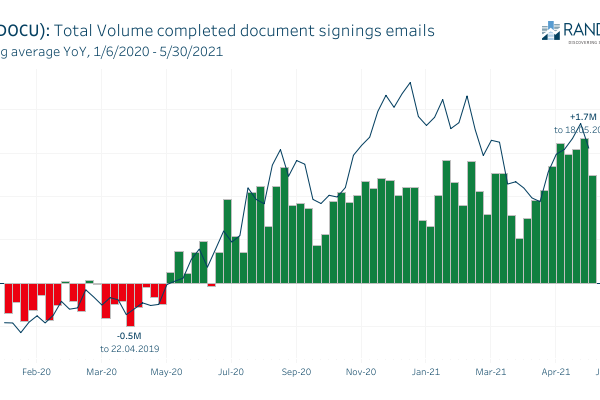

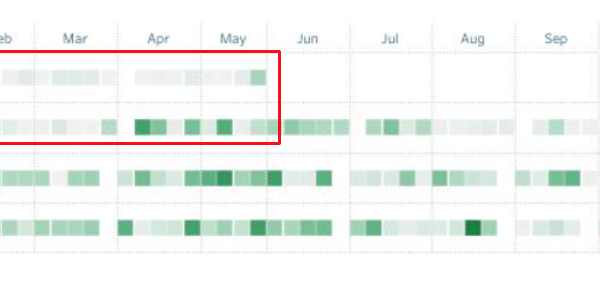

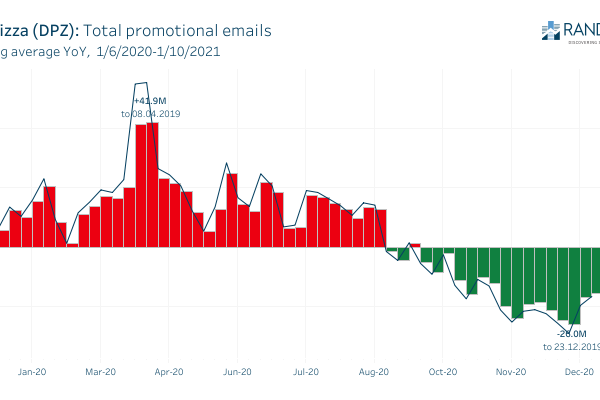

Our promotional ensemble tracks millions of email messages from nearly 400 leading consumer brands to detect changes in language that can reveal inflections in demand.

Retail Desperation Indices

Monitor when brands are struggling to move inventory and change their language to extend sales, increase markdowns, or move more products to clearance.

Best In Industry Promotional Data Repository

Our tehcnology team has been storing, categorizing, parsing hundreds of millions of emails dating back to 2017.

IDENTIFYING INFLECTIONS

Our Email classification engine uses NLP and machine learning to quantitatively track trends in discounting and promotions.

PROMOTIONAL EMAIL INSIGHTS

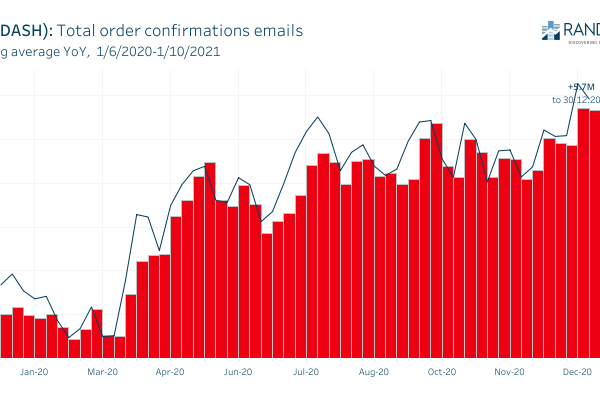

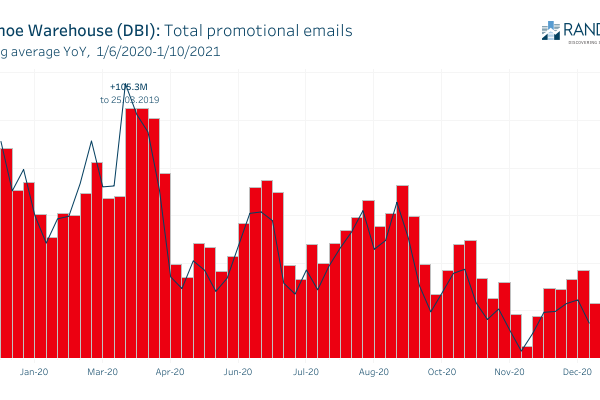

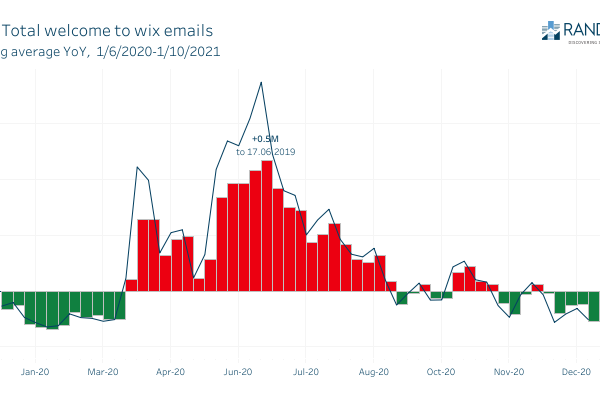

Our team generates and maintains the industry’s most accurate quantitative promotional trend data for over 300 brands. Our data scientists, natural language processing python developers, email systems experts, software engineers focus on creating the most robust insights in how brands are communicating with customers and leads. Random Walk’s focus is not telling our institutional investors how to do invest, but instead providing them with very clear quantitative measurable data visualizations. Specifically, we deliver a promotional ensemble that provides a picture of potential trend changes and inflections. The easiest method management teams have to react to poor demand is to ramp email activities and our systems alert investors before the market to these changes

FOUNDER, GREG ROBIN

Greg Robin is the founder of Random Walk. He has over twenty years experience in finance and delivered big data insights to investors long before it was popularized on the street. He has a background in computer science with a graduate degree in distributed systems and has a background in search engine optimization having worked with over a dozen publicly traded companies. He previously held his research analyst Series 86/87, Series 24, Series 7, Series 4.

Greg Robin is the founder of Random Walk. He has over twenty years experience in finance and delivered big data insights to investors long before it was popularized on the street. He has a background in computer science with a graduate degree in distributed systems and has a background in search engine optimization having worked with over a dozen publicly traded companies. He previously held his research analyst Series 86/87, Series 24, Series 7, Series 4.

DENISE APTEKAR, ADVISOR

Denise Aptekar helps drive the strategic vision for Random Walk. Denise has achieved success in the fintech space as one of the first PayPal team members, later a team member for Upwork. She has provided management consulting as well as successfully invested in several pre IPO successes. Denise is a Stanford graduate and long time Silicon Valley resident.

Denise Aptekar helps drive the strategic vision for Random Walk. Denise has achieved success in the fintech space as one of the first PayPal team members, later a team member for Upwork. She has provided management consulting as well as successfully invested in several pre IPO successes. Denise is a Stanford graduate and long time Silicon Valley resident.

KLAUS SCHULTE, DATA VISUALIZATION

Dr. Klaus Schulte is a master in data visualization and leads the design and implementation of Random Walks promotional ensemble primarily within Tableau. Klaus is a professor and CEO of CO data GmbH and has been awarded the honor of Iron Viz Champion and is recognized as a Tableau Zen Master

MATT GORDON, ANALYST

Matt Gordon serves as an Analyst for Random Walk identifying big data insights to share with institutional investors. He is leading efforts to uncover larger inflections mapping our email intelligence to operating trends and KPIs. He has passed the CFA Level 1 Exam and served in credit and equity analyst roles. He holds a B.S. in Finance from the University of Delaware where he served as a Sector Head in the Blue Hen Investment Club.

Matt Gordon serves as an Analyst for Random Walk identifying big data insights to share with institutional investors. He is leading efforts to uncover larger inflections mapping our email intelligence to operating trends and KPIs. He has passed the CFA Level 1 Exam and served in credit and equity analyst roles. He holds a B.S. in Finance from the University of Delaware where he served as a Sector Head in the Blue Hen Investment Club.

WE’RE IN SAN DIEGO

To help protect our clients’ edge we maintain a narrow distribution. Give us a call to see if we can work together.

CONTACT US

Random Walk Financial

PO Box 7138

Rancho Santa Fe, CA 92067

email: sales AT ranwalk DOT com