Why Credit Card Data Fails

Big data in investing is here and we are a part of it. However, some institutional investors are getting confused as to the end zone.

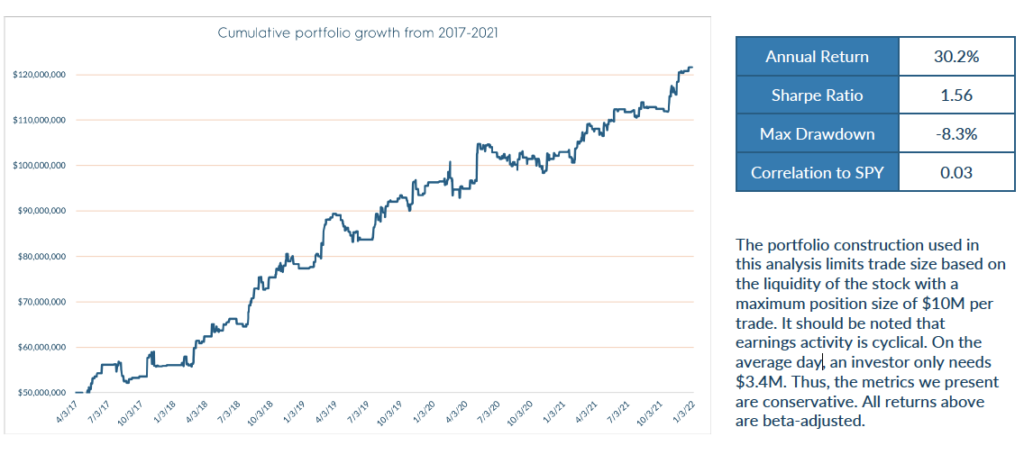

There are several expensive credit card transaction products that correlate well with coincident revenues some of the time. With Wall Street investors trained to drool at regressions, error bands and correlations, the allure that these products can do the decision making is appealing. While often accurate in predicting some component of revenues, this “data” approach has herded investors into a series of grossly inaccurate conclusions on consumer stocks in 2017.

To be specific, the largest big-data transaction vendors led investors right to slaughter in a wide range of mall based retailers this spring. Ironically, the data generally projected somewhat accurate revenues in names including JC Penny (JCP), Macy’s (M), Foot Locker (FL), Michael Kors (KORS), Vitamin Shoppe(VSI) and several others. In summary, the transactional data indicated results were to be inline, an expensive and grossly wrong conclusion.

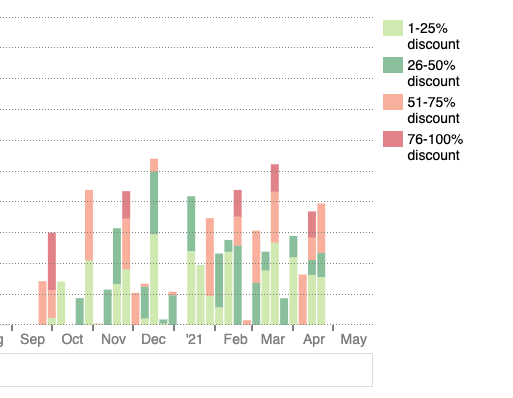

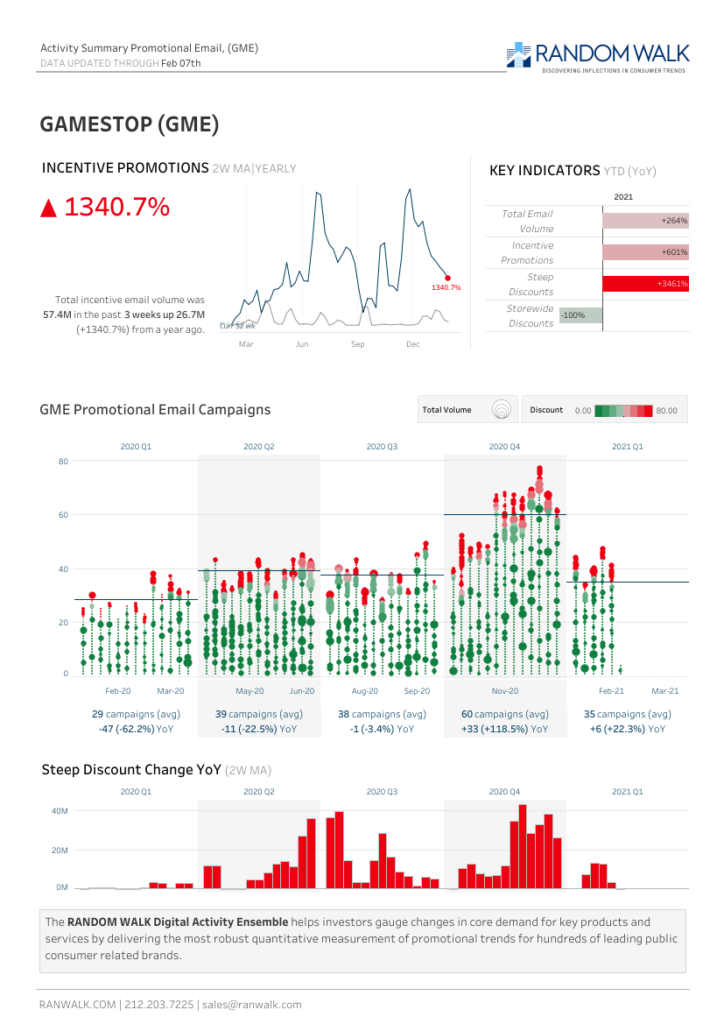

Why did this expensive credit card data fail miserably? Look how tight those error bands are! The transactional data provided no context into organic demand of these products. Credit card receipts did not factor in the desperation among retailers engaged in their steepest discounting in history. Share prices collapsed and investors overly focused on transactional data were left with a classic Pyrrhic victory, attempting to take solace with the mantra of “but we were right on revenues”.

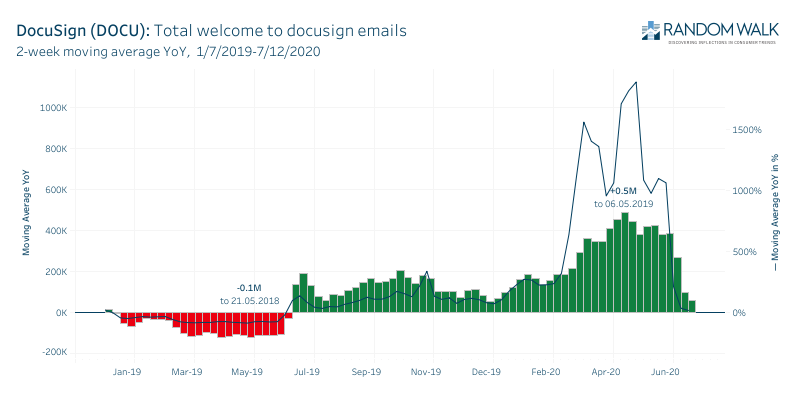

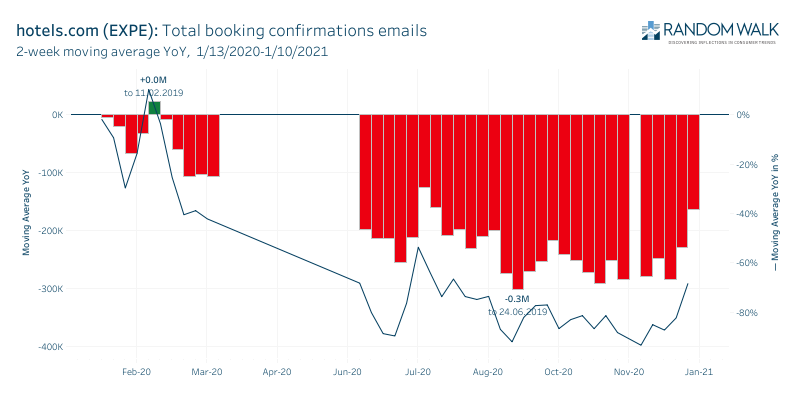

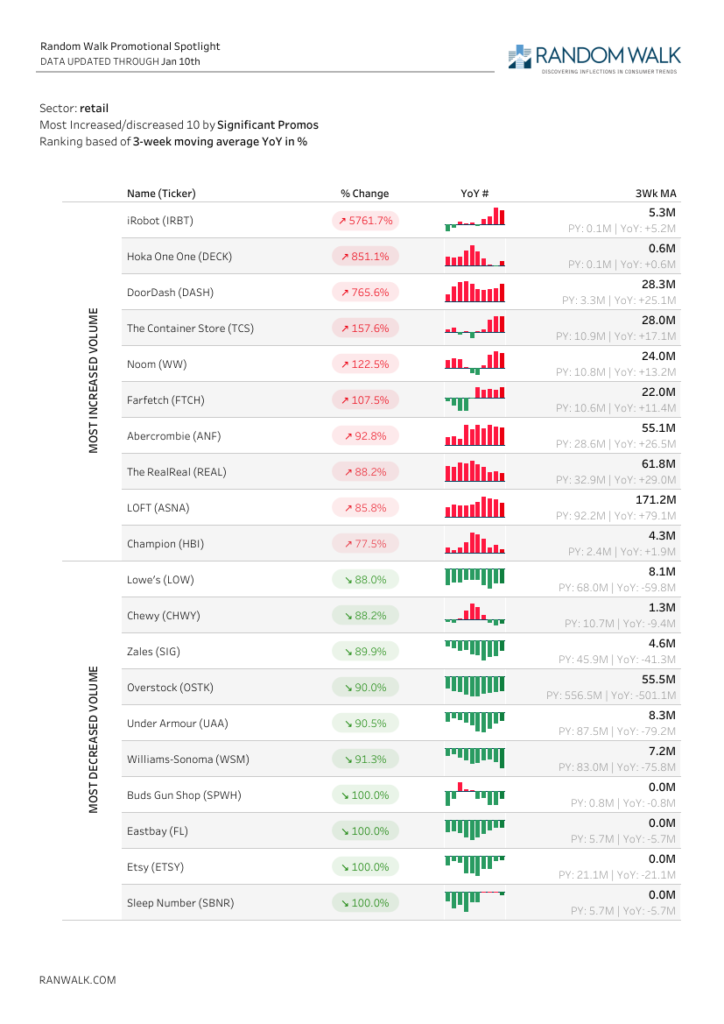

Other times, the transactional data is correct most of the time when its business as usual, then misses the largest move because something unusual has occurred the sample did not detect. So investors are correct, when there is no money to be made, and wrong right when a business is about to be dramatically revalued due to a massive inflection in demand. Vitamin Shoppe (VSI) comes to mind in this scenario. The Random Walk ensemble captured the 50% plus collapse in business as customers migrated to Amazon and stopped by placebo pills altogether. Through a combination of click stream data, review volumes, email responses our more robust, less precise approach generated alpha for our clients.

In terms of risk reward, compounding the problem is the herding mechanism related to this mass consumption transactional data. Every highly transactional, well resourced hedge fund is viewing the identical data sets, yielding the same conclusion. This now incorrect herd exacerbates the share price collapse as panicked analysts- now uncommitted shareholders all attempt to rush through a tiny exit door at once.

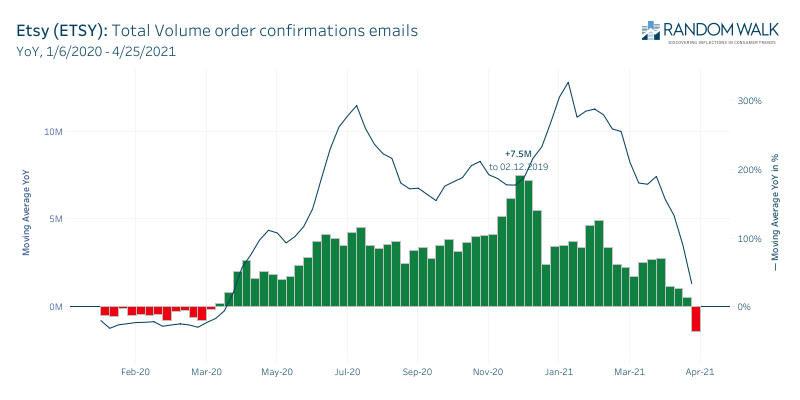

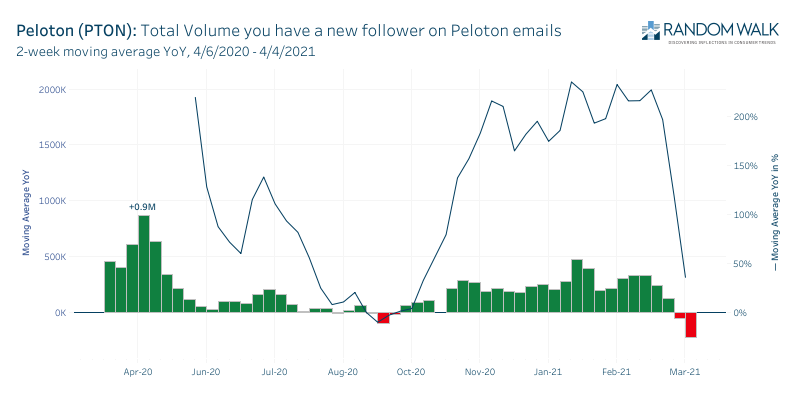

In contrast, our more robust and diverse data ensemble can be less precise for coincident revenues, but more ACCURATE in predicting changes in consumer behavior that ultimately influence share price. Our view is that new customer acquisition volumes, organic demand for products and repeat customer frequency drive share price. These are the metrics we focus on predicting because the relate future growth. We don’t want to predict the present or past.

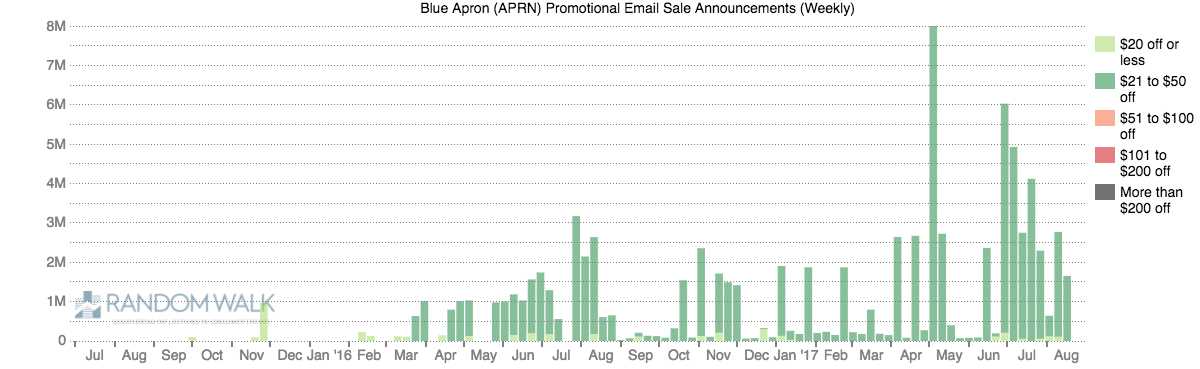

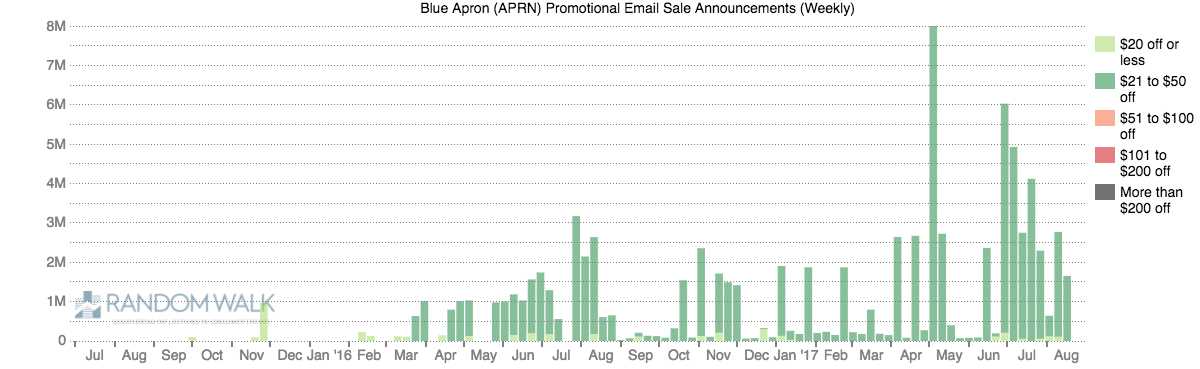

Our data ensemble detects Blue Apron giving away food to attempt to bring back past customers.