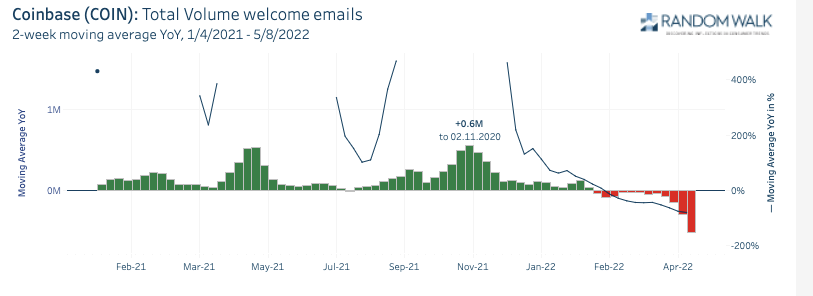

> Email Intelligence successfully detected the collapse of one of the biggest FOMO driven manias in US history: “crypto trading”.

> Random Walk ensemble alerted investor partners to sharp deceleration in orders, new account “welcome” confirmations, as well as a higher deletion rate for new product offerings.

> Wall Street bankers and analysts, motivated to sell the management “narrative”, extrapolate unsustainable growth rates into the future, but RW data can help uncover inflections

In 2020 and into 2021 our data indicated strong, but likely transient growth in new “Welcome to Coinbase” email confirmations. This unsustainable growth was driven by a ‘Black Swan’ mosaic of factors: bored locked down Americans, unprecedented Uncle Sam stimulus checks, and social media FOMO pictures of teens in pajamas getting rich trading Crypto Kitties.

After lockdowns and free money ended in late 2021 our ensemble uncovered slowing in new customer confirmation emails, and we added COIN to our slowing list.

‘GENIUS’ SUPER BOWL QR AD GENERATES CLICKS NOT CUSTOMERS

Above: Super Bowl Ad fails to generate customers, but drove worthless clicks due to its nebulous nature

Several additional data driven trends revealed themselves earlier this year. The inability for a $14 million Super Bowl ad to attract new customers was apparent as our data detected no spike in new accounts. While the media focused on worthless “clicks” our data showed a lack of actual new customers. Management hubris led to equivocating marketing a crypto-trading platform with proven consumers products such as alcohol/beer, quick service restaurants, auto, apparel etc.

EMAILS PROMOTING SUBSCRIPTION, NFT PRODUCTS DELETED

In March, our email intelligence indicated very high delete rates for new products marketed with email promotions such as Coinbase One, and Coinbase NFTs. With gas at $6 a gallon and $25 hamburgers and rising rates, consumers had lost interest, as they prioritized getting to work and feeding their families over possessing digital unicorn.

BITCOIN SPIKES, TRADING VOLUMES DON’T

The lack of interest in trading “cryptos” despite a spike in bitcoin after Putin invaded Ukraine showed in our data and confirmed the slowing trend.

AS BROADER EQUITY MARKETS CORRECT, CUSTOMER GROWTH ENDS

Once the high growth equity tech bubble began to collapse and consumers saw their 529 plans, 401ks, and brokerage accounts decline, they quickly shifted their preferences away from crypto trading.

Download the full Coinbase PDF here