KPI Mania: Celebrating in the Wrong End Zone

DoorDash (DASH), The Children’s Place (PLCE) , Etsy (ETSY), Restoration Hardware (RH)

Recently, third-party software platforms have emerged to track alt-data precision in KPIs such as subscribers, GMV, and revenues. The gamification of coincident indicator tracking has investors sprinting to the wrong end zone.

The revenue precision prediction game was highly effective during ZIRP, growth at any cost, 4 IPOs a day, 2 unicorns a week era. However, with a normalized cost of capital environment likely to persist, the ability to generate organic demand translating to earnings and future profits will TRUMP hitting current quarter revenue targets.

Commentary and guidance around future organic growth will generate alpha, not doing a touchdown dance in the revenue precision end zone. Being privy to excessively granular details such as that business slowed for 3.5 days due to rain isn’t likely to be rewarded in the markets if unrelated to longer-term organic growth.

he allure of data science mixed with hubris has created an eco-system with dozens of venture-backed alt data firms all purporting to be able to predict current quarter revenues with a tiny margin of error. Herding then compounds this with poor risk-reward. There is too much supply of data predicting the present with a black hole on the profitability and sustainability of such sales.

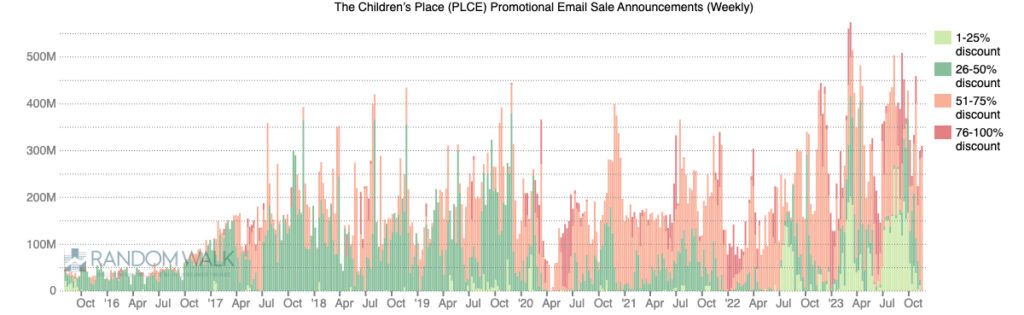

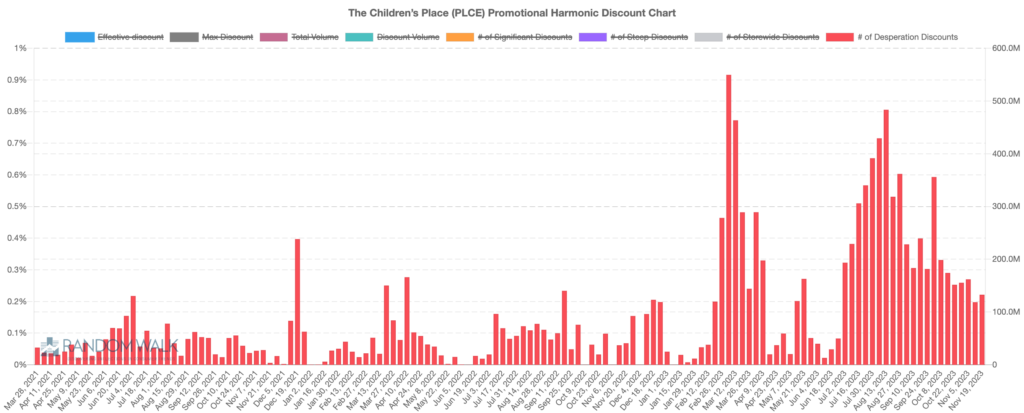

Experienced investors realize management has a wide range of tricks to meet their quotas such as pulling forward demand or spamming customers with coupons and promotions. With lead and customer lists in the millions, brands can quickly escalate discounting intensity until the product is moved.

The Random Walk Promotional Ensemble provides the most real-time and accurate view into this changing behavior. We uncover brands with the most egregious behavior changes behind-the-scenes email campaign blasts they are attempting to hide from institutional investors.

Recent results in Children’s Place (PLCE) reveal this disconnect. PLCE reported above consensus revenues of $480 mm vs. consensus of $465mm, yet guided the holiday quarter to a paltry $0.35 in earnings a dollar below expectations. Investors overweighing clickstream conversions and credit card data in their methodology scored touchdowns in the KPI end zone.

Meanwhile, our promotional ensemble alerted clients to unprecedented email volume, steep discounts, and never-seen-before language. This pattern is similar to other brands that have eventually evaporated from the public markets such as JCP and BBBY.

Explosive growth in promotions is the easy ‘tell’ that brands have lost their pricing power and ability to differentiate in a hyper-competitive marketplace in the shadow of Amazon.

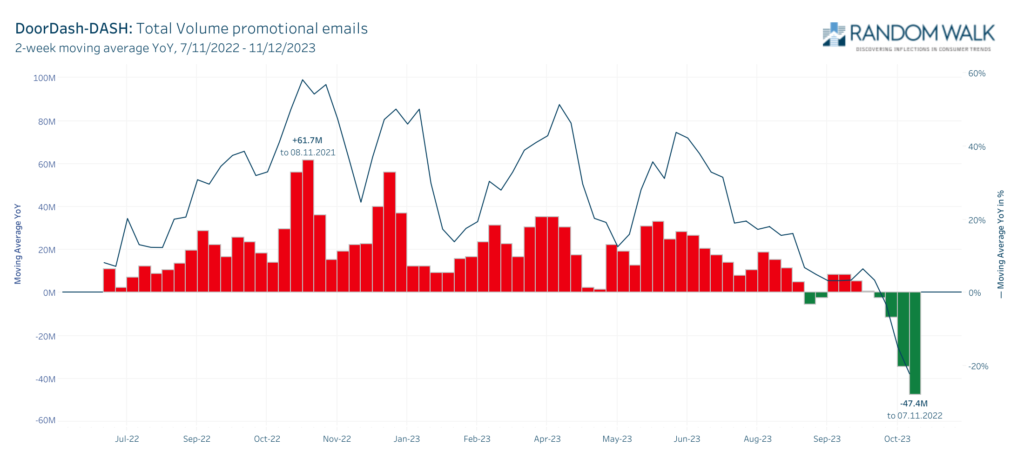

On the flip side, the Random Walk Promotional Ensemble revealed several businesses relying on fewer promotions and discounts. In DoorDash, we tracked a significant decline in the various promotions and discounts DASH has used in the past to draw new customers. We also captured fewer incentives for existing customers. This won’t translate to a precision GOV forecast, but reveals something much more valuable: Management is seeing stronger than prior period organic demand growth for its core product!

Soon after reducing the incentives, DoorDash reported nearly 300% growth in EBITDA and noted across-the-board acceleration.

Don’t get fooled into winning the academic decathlon of profitless predictions for revenues. Our promotional ensemble provides unique insight into how management reacts to changing demand. When demand sags, brands ramp up email-sending volume. With software to target various cohorts and segments “coupon clipping” will miss the first signs of slowing. Well before Etsy (ETSY) and Restoration Hardware (RH) reduced guidance they were dramatically increasing their email campaigns. The coupon clippers missed this because there were no coupons. Initially, in the face of slack demand, they increased the frequency of pinging their customers and leads with a variety of “check out our new furniture” type campaigns. Our total email volume index alerted investors to these changes, warning them.

Share :