- ULTA: Inflection in Email Marketingby Greg Robin

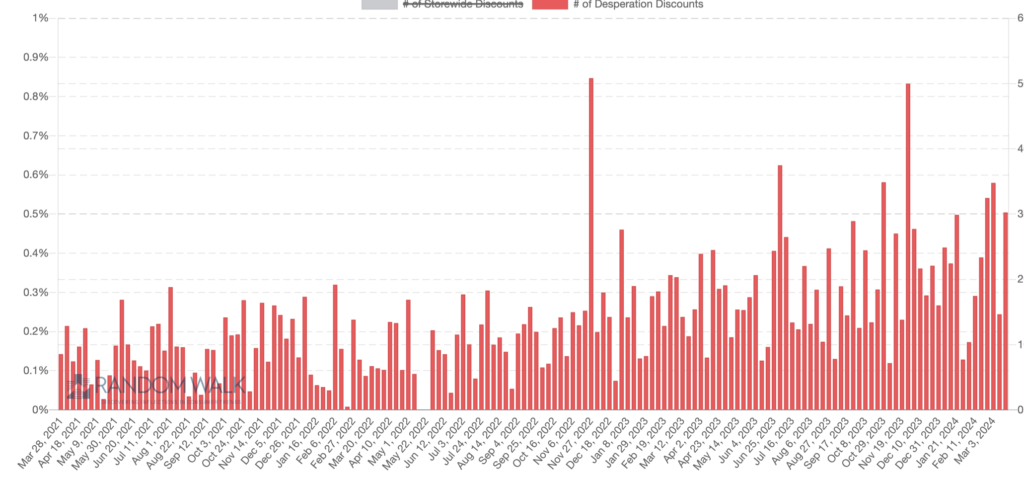

Acceleration in nearly every promotiponal email index conveys a change in strategy. Ulta appears increasingly reliant compared to past periods on ‘push’ discounts to beauty shoppers.

Random Walk Desperation Index, Steep Discount Index and Significant Discount Index are all either approaching or setting new highs this Spring.

New campaigns attempting to drive online engagement and conversion include:

“Open this email for FREE gifts and 50% off”

“FREE 4PC MAC Gift”

“FREE 17 PIECE SET”

Desperation Index. Our new desperation index tracks growth in certain keywords within email campaigns such as “extended”, “free shipping”, “urgent” and “one more day” to name a few.

Steep Discount Index Our systems classify any coupon with an implied discount 40% off or steeper as steep. Recently Ulta has used much more 50% off language.

Significant Discount Volumes Our significant discount index tracking any coupon impacting the price has also shown acceleration beyond seasonal norms.

- Promotional Ensemble Comparison: Etsy vs Walmartby Greg Robin

COVID Masks and Crafts vs. Feeding the Family

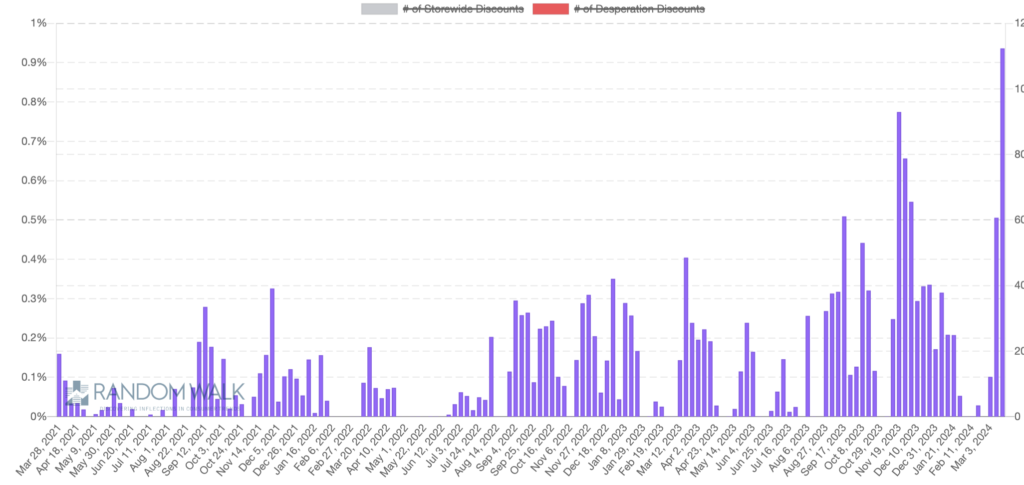

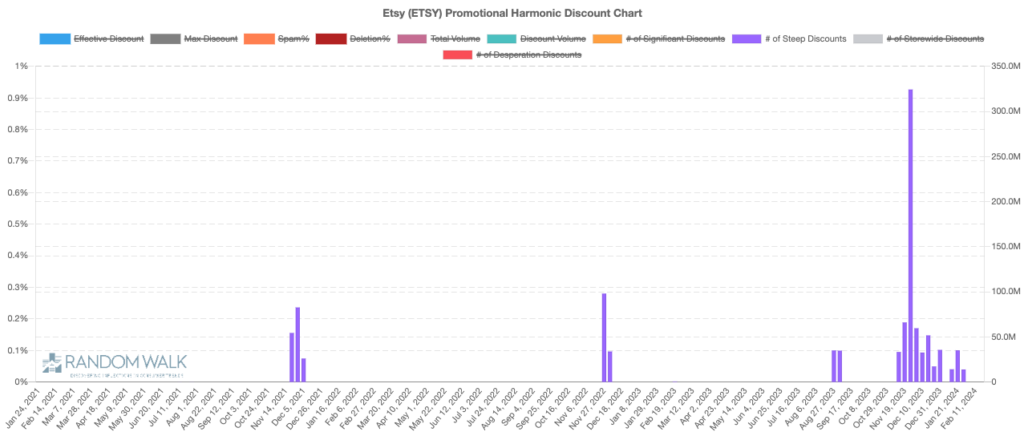

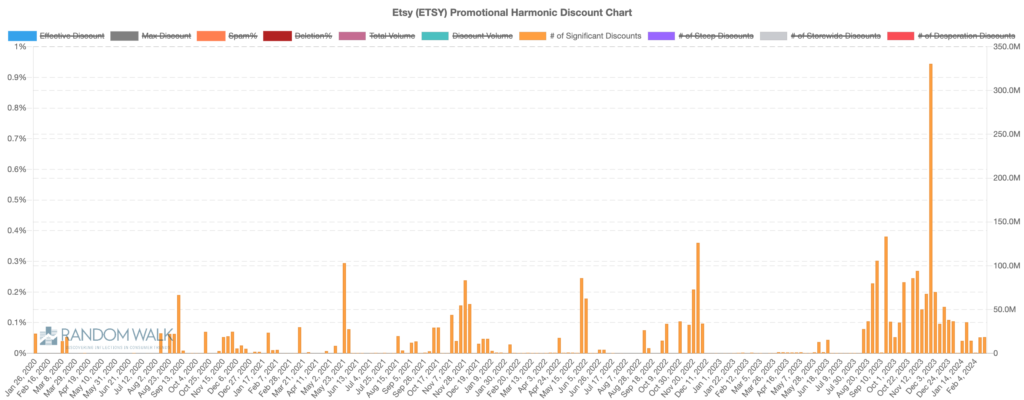

ETSY: Ensemble revealed new discount campaigns ahead of reduced outlook.

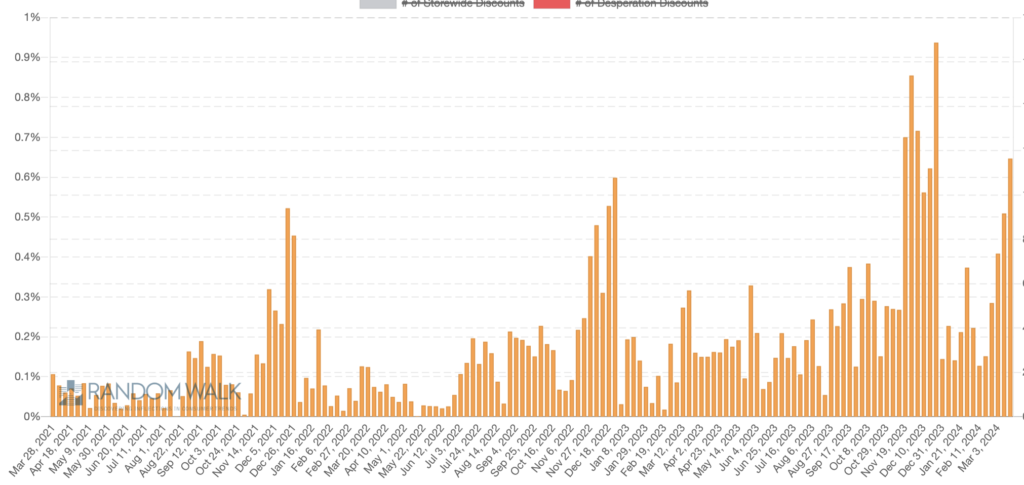

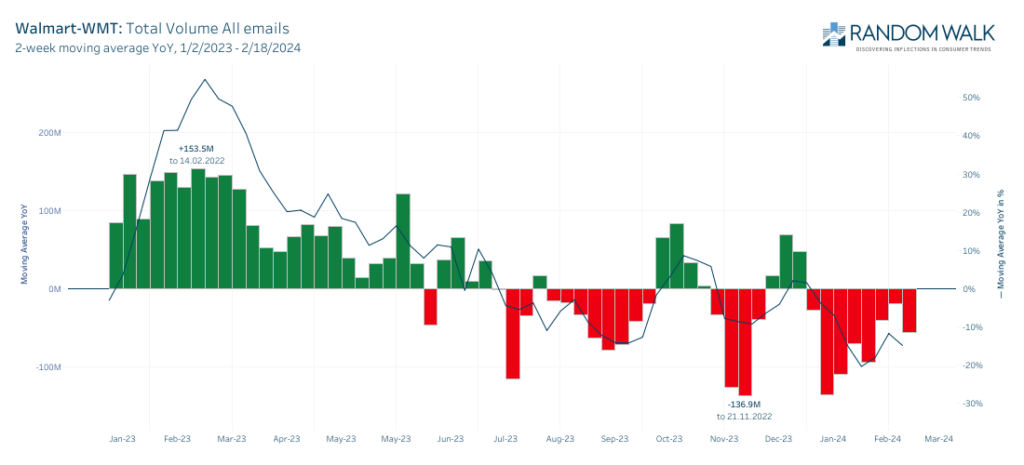

WMT: Ensemble tracked fewer email campaigns, and declining promotional discounts before improved inventory position and strong outlook.

While our competitors focus on precisely tracking revenues our promotional ensemble provides a more predictive gauge of organic demand. Our technology can uncover changes in how brands communicate with customers and leads.

With the holidays in the rear-view mirror, it appears demand receded, and management responded by ramping up the implied discount language in emails. We captured more campaigns using 40% off language for specific categories. These campaigns and language had never been used before.

Persistent declining sales for the mature marketplace provides clues that consumer preferences have shifted. Gone are the lockdown and stimulus-related tailwinds driving interest in at-home crafts, masks mini calendars, dog sweaters, cute cocktails mixology and other unessential at-home items.

As food costs have spiraled out of control consumers have shifted to the perceived value provided by Walmart.

Wall Street’s ‘silo’ style of coverage creates the opportunity as one analyst covers ‘internet’ with Etsy and entirely different team covers consumer staples and Walmart. Both are now technology companies. Our sector agnostic data driven approach makes it easy to compare the two. As seen in our composite, Walmart is clearly responding to improved inventory levels and robust demand by reducing their email campaigns and discounts

- KPI Mania: Celebrating in the Wrong End Zoneby Greg Robin

DoorDash (DASH), The Children’s Place (PLCE) , Etsy (ETSY), Restoration Hardware (RH)

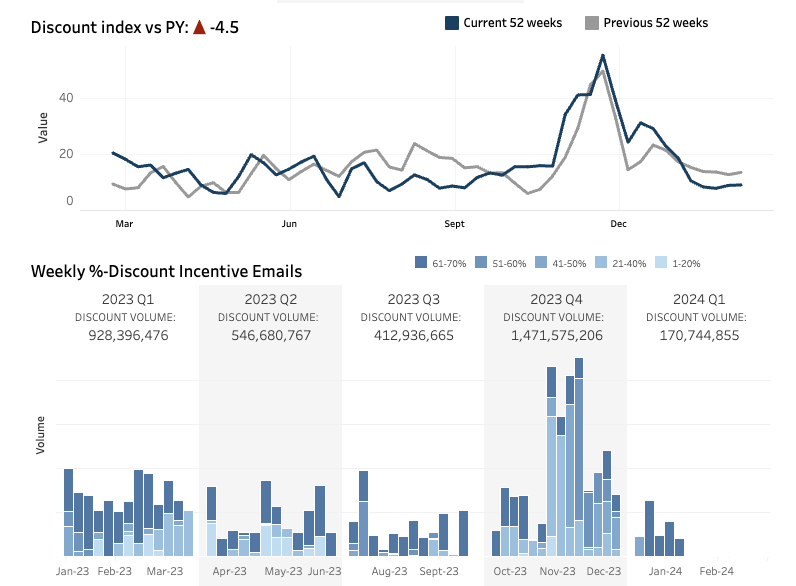

Recently, third-party software platforms have emerged to track alt-data precision in KPIs such as subscribers, GMV, and revenues. The gamification of coincident indicator tracking has investors sprinting to the wrong end zone.

The revenue precision prediction game was highly effective during ZIRP, growth at any cost, 4 IPOs a day, 2 unicorns a week era. However, with a normalized cost of capital environment likely to persist, the ability to generate organic demand translating to earnings and future profits will TRUMP hitting current quarter revenue targets.

Commentary and guidance around future organic growth will generate alpha, not doing a touchdown dance in the revenue precision end zone. Being privy to excessively granular details such as that business slowed for 3.5 days due to rain isn’t likely to be rewarded in the markets if unrelated to longer-term organic growth.

he allure of data science mixed with hubris has created an eco-system with dozens of venture-backed alt data firms all purporting to be able to predict current quarter revenues with a tiny margin of error. Herding then compounds this with poor risk-reward. There is too much supply of data predicting the present with a black hole on the profitability and sustainability of such sales.

Experienced investors realize management has a wide range of tricks to meet their quotas such as pulling forward demand or spamming customers with coupons and promotions. With lead and customer lists in the millions, brands can quickly escalate discounting intensity until the product is moved.

The Random Walk Promotional Ensemble provides the most real-time and accurate view into this changing behavior. We uncover brands with the most egregious behavior changes behind-the-scenes email campaign blasts they are attempting to hide from institutional investors.

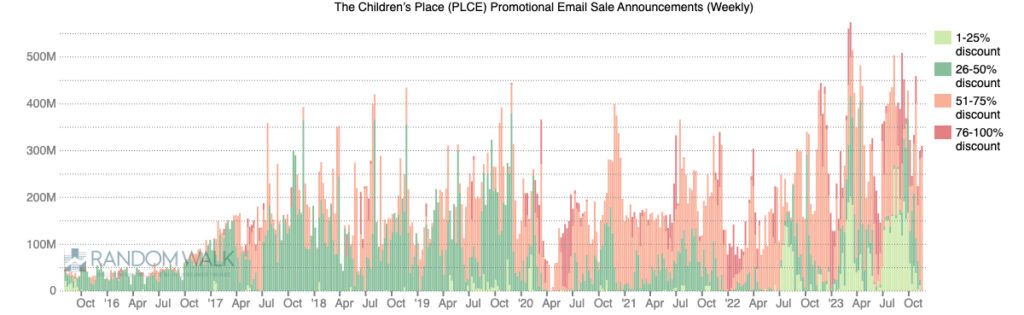

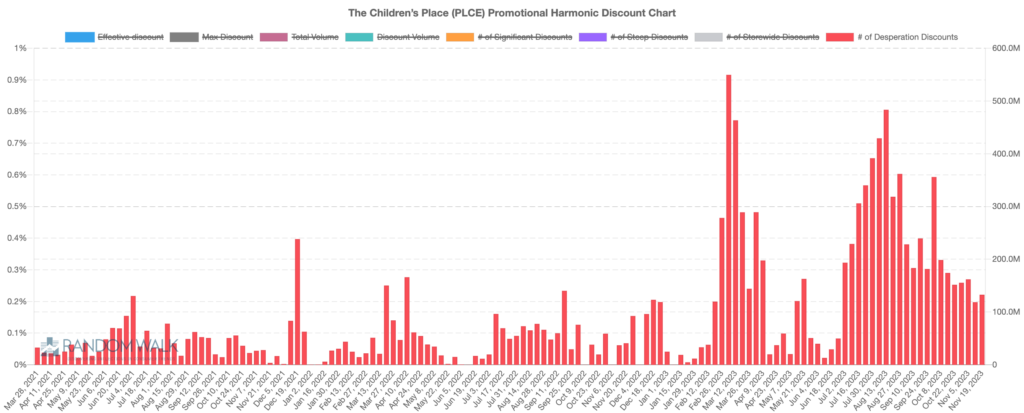

Recent results in Children’s Place (PLCE) reveal this disconnect. PLCE reported above consensus revenues of $480 mm vs. consensus of $465mm, yet guided the holiday quarter to a paltry $0.35 in earnings a dollar below expectations. Investors overweighing clickstream conversions and credit card data in their methodology scored touchdowns in the KPI end zone.

Meanwhile, our promotional ensemble alerted clients to unprecedented email volume, steep discounts, and never-seen-before language. This pattern is similar to other brands that have eventually evaporated from the public markets such as JCP and BBBY.

Explosive growth in promotions is the easy ‘tell’ that brands have lost their pricing power and ability to differentiate in a hyper-competitive marketplace in the shadow of Amazon.

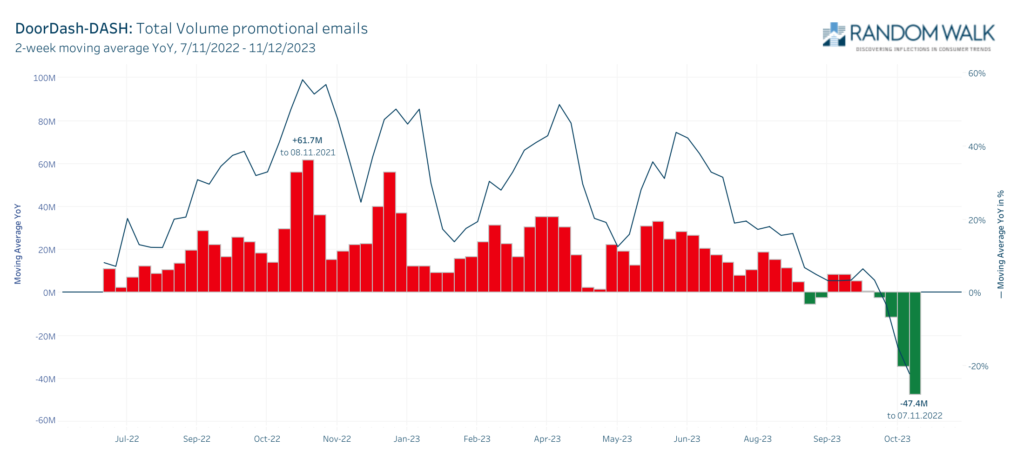

On the flip side, the Random Walk Promotional Ensemble revealed several businesses relying on fewer promotions and discounts. In DoorDash, we tracked a significant decline in the various promotions and discounts DASH has used in the past to draw new customers. We also captured fewer incentives for existing customers. This won’t translate to a precision GOV forecast, but reveals something much more valuable: Management is seeing stronger than prior period organic demand growth for its core product!

Soon after reducing the incentives, DoorDash reported nearly 300% growth in EBITDA and noted across-the-board acceleration.

Don’t get fooled into winning the academic decathlon of profitless predictions for revenues. Our promotional ensemble provides unique insight into how management reacts to changing demand. When demand sags, brands ramp up email-sending volume. With software to target various cohorts and segments “coupon clipping” will miss the first signs of slowing. Well before Etsy (ETSY) and Restoration Hardware (RH) reduced guidance they were dramatically increasing their email campaigns. The coupon clippers missed this because there were no coupons. Initially, in the face of slack demand, they increased the frequency of pinging their customers and leads with a variety of “check out our new furniture” type campaigns. Our total email volume index alerted investors to these changes, warning them.

- Promotional Ensemble & Gross Marginsby Greg Robin

Random Walk email intelligence through our promotional ensemble delivers the most quantitative and predictive tracking of implied discounts and promotional cadence available. When brands are struggling to generate organic demand they ramp up sending volume to their leads and customers. We capture these potential inflections in near real-time and alert our investor partners ahead of the street.

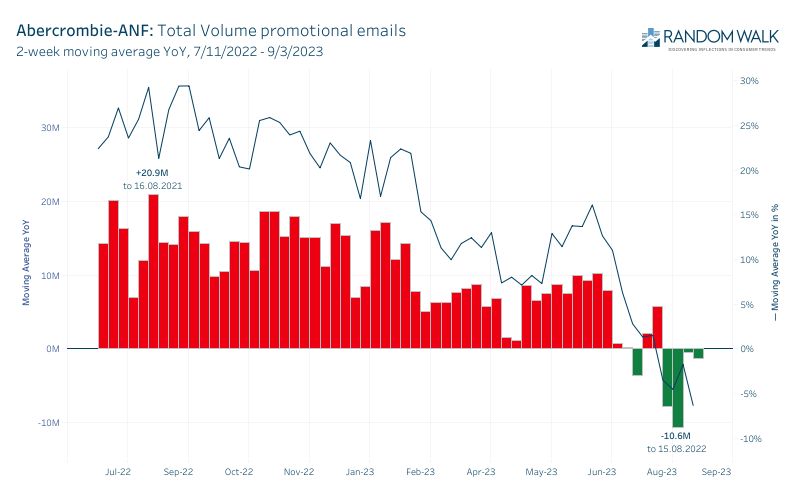

- Abercrombie & Fitch (ANF)

TOTAL PROMOTIONAL VOLUME + 9% GROSS MARGIN +460bps

- The Children’s Place (PLCE)

STEEP DISCOUNT VOLUME +75% GROSS MARGIN: -480bps

- Farfetch Limited (FTCH)

SIGNIFICANT DISCOUNT VOLUME +127% GROSS MARGIN -370bps

- Foot Locker, Inc. (FL)

STEEP DISCOUNT VOLUME +79% GROSS MARGIN: -460bps

- Hibbett, Inc. (HIBB)

STEEP DISCOUNT VOLUME +108% GROSS MARGIN: -160bps

- Olaplex Holdings, Inc. (OLPX)

TOTAL PROMOTIONAL VOLUME +650% GROSS MARGIN: -550bps

- Petco (WOOF)

STEEP DISCOUNT VOLUME +780% GROSS MARGIN: -140bps

- Ulta Beauty (ULTA)

STEEP DISCOUNT VOLUME +107% GROSS MARGIN -110bps

- Walmart Inc. (WMT)

STEEP DISCOUNT VOLUME-37% GROSS MARGIN 40bps

ANF: Sharply declining total promotions translate to gross margin gains of 460bps

OLPX: Exploding total promotional volumes translate to forecast gross margin delcines of 600bps - Random Walk Promotional Outlier Focus: Nike Partners Sending Record Discountsby Greg Robin

Random Walk New Keyword Tracker Launched. Our new technology helps investors instantly detect changes in the promotional intensity brands are using to communicate with leads. Detect inflections in core demand through tracking of desperation keywords in emails such as “extra”, “extended”, and “one more day”.

Keyword tracker uncovered the largest ever spike in “Nike” related keywords from key wholesale partner email correspondance over the past two weeks.

PREVIEW: Promotional Outlier Focus: Nike Partners Sending Record Volume of Discount Campaigns

ASO, DKS, FL, M, NKE, SCVL

Last quarter, Nike reported slowing revenue growth as consolidated revenue increased year-over-year by 5%, down from 14% year-over-year growth in the prior quarter. While total promotional activity direct from Nike is stable, we are capturing record breaking volumes of Nike coupons from wholesale partners implying lagging organic demand. We also anticipate a weak quarter for Foot Locker, which purchased 65% of its athletic merchandise from Nike during the most recent fiscal year.

NIKE PARTNER PROMOTIONAL HIGHLIGHTS

Foot Locker (FL) sent record volumes of “Nike” focused promotions in July. We have tracked a 67% year-over-year increase in email volumes containing “Nike” for the May-July period

.Academy Sports & Outdoors (ASO) sent greater volumes of “Nike” focused promotions this Summer. We tracked a 49% year-over-year increase in email volumes containing “Nike” for the May-July period.

Shoe Carnival (SCVL) Shoe Carnival “Nike” focused promotion volume increased by 2,783% on a year-over-year basis for the May-July period.

Macy’s (M) We captured a rare “Special 20-25% off from Nike”.

- NEW: Promotional Heat Maps by Subsectorby Greg Robin

June 28

We recently launched a new product that examines trends of promotional activity within subsectors.

Highlights:

- Footwear promotional volume continues to accelerate higher. 9 of the 13 tickers in our footwear index exhibited a “worsening” promotional trend last week with 12 of 14 worsening on a monthly basis.

- Luxury Retail demand appears weak as significant promotional volume has worsened on a YoY rate of change basis at several major companies in our subsector index.

- The Sporting Goods subsector has emerged as another addition to the worsening list. All 8 companies in this index have sent out substantially higher promotional volume in the most recent week compared to the prior year.

- Outdoor Apparel promotions continue to stand out as significant promotion volume YoY growth for this subsector exceeded 100% in three consecutive weeks recently.

- Demand doesn’t appear to be returning at home improvement retailers. Promotional volume is substantially higher at all 5 companies in our index compared to the prior year.

- Ramping Promotional Campaigns in Home Goods Indicate Slowdown Acceleratingby Greg Robin

BIG, FND, HD, LOW, LOVE, LZB, OSTK, RH, W, WSM

Matt Gordon

Greg Robin

APRIL 20, 2023

Random Walk Email intelligence suggests management is responding to fading organic demand in home furnishings and home improvement with more aggressive pushed offers to their leads lists this spring

Home and home furnishing related names have been more aggressive in sending promotions to leads this April compared to last, with Wayfair (W) and Pottery Barn(WSM) as standouts on our slowing list. Each had more faster ramps year-over-year promotion growth in significant discounts.

Home improvement retailers Home Depot (HD) and Lowe’s (LOW) are dealing with declining demand in part by sending new and more frequent email promotions to leads. We also recently captured new spring holiday language unseen in prior years.

In terms of fastest growers of total email volumes Floor & Decor (FND) stands out. Total promotional volume is a good way to measure concerns from brands that do not discount such as Restoration Hardware(RH). As can be seen above, RH is sending more communications to leads, despite no significant discounts outside of the outlet.

Our updated promotional ensembles provide the most robust, quantitative and rigorous views of how brands are communicating with leads.