- ANF: Improving Abercrombie Promotional Ensemble Uncovers Inflection sentby Greg Robin

Management commentary consistent with our promotional ensemble tracking fewer discount campaigns:

>”Abercrombie brands made sequential progress in-line with our expectations, and we are tightly managing inventory as we aim for fourth quarter brand net sales to be approximately flat to last year’s record. “

> “…keeping inventory tight while continuing to flow in newness allowing for AUR improvement on lower promotions.”

- Bath & Body Works (BBWI) vs Walmart(WMT): Diverging Preferences Revealedby Greg Robin

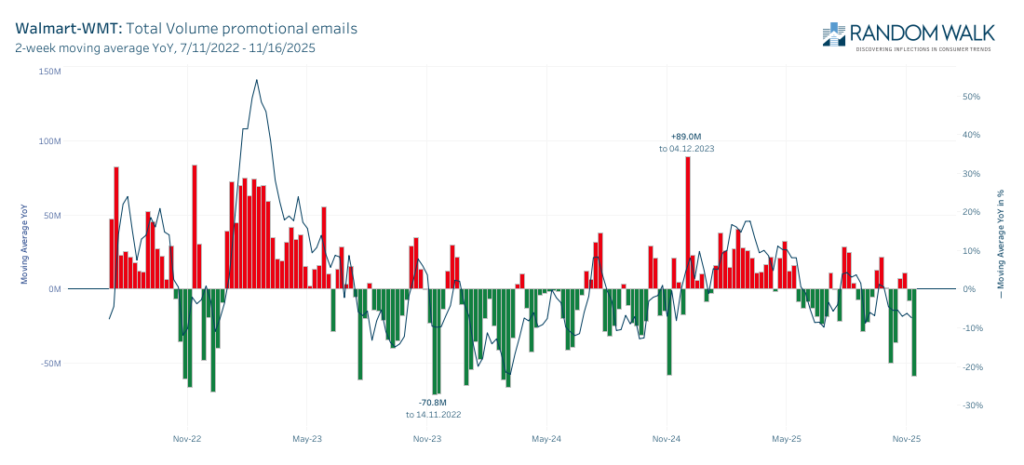

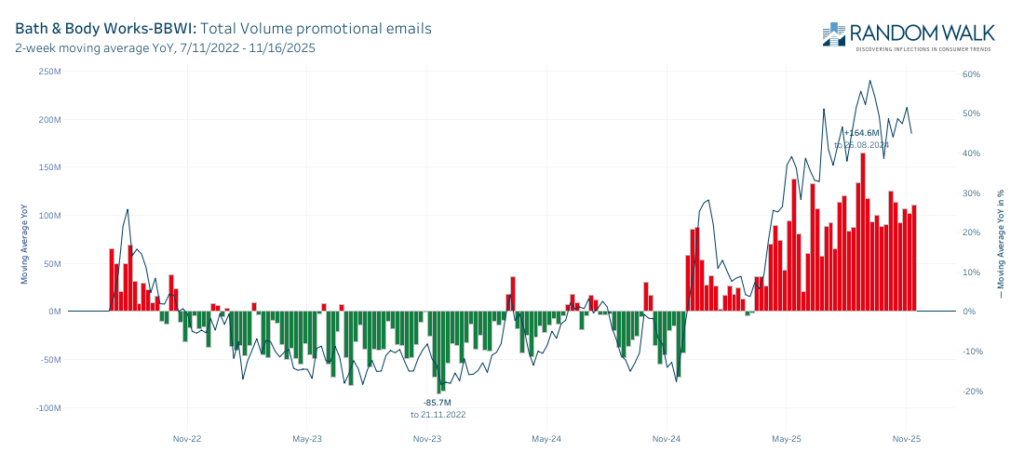

With rampant inflation continuing to chew into consumers purchasing power, we continue to see a shift away from demand for discretionary knick-knacks towards critical household staples including food and clothing. The diverging promotional growth patterns in BBWI and WMT make this trend apparent.

> BBWI forecast high single digit declines for the critical Q4 holiday quarter, noting a challenging start to holiday shopping beginning in Q3 … highly competitive environment”.

>. BBWI management’s final comment directly aligns the the email campaigns we tracked “…our customers are waiting for deeper discounts before making purchases.”

> Gross Profit Rate declined 220 basis points as management noted “increased promotional activity to clear inventory”.

> Walmart (WMT) vs Bath & Body Works (BBWI) Not all retailers are exploding their promotional campaigns and email volumes. As seen below WMT total volumes actually declined into peak shopping season as consumer preferences shifted towards cost effective core needs and away from discretionary scented candles and bubbles..

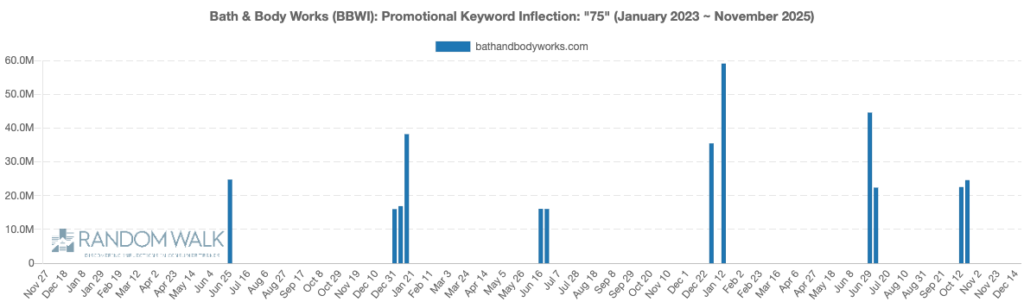

We captured explosive growth in 75% off campaigns from BBWI

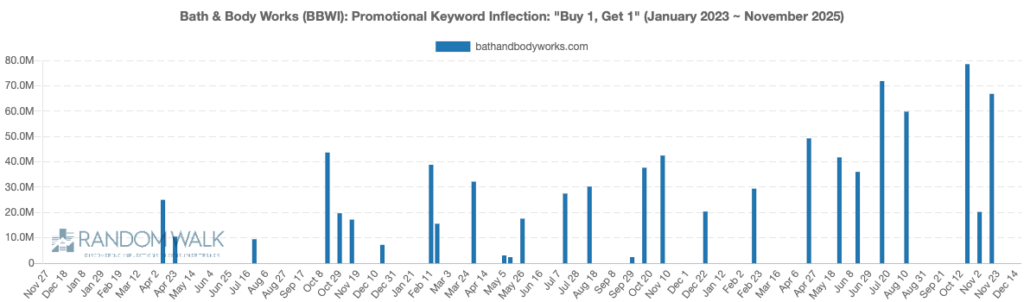

Additionally BBWI was forced to grow BOGO campaigns by nearly 300%

- CMG, CAKE CAVA, CBRL, MCD, YUM: Unusual Email Campaignsby Greg Robin

Our promotional ensemble was successful in detecting the inflection in Chipotle and Cava. As organic demand slowed both ‘bowl’ sellers began offering more and more freebies to their most loyal customers. Additionally, “new” product promotions and deals were send to a higher percentage of their lists. Instead of select targeted campaigns, massive blasts triggered our promotional ensemble.

https://vimeo.com/1120670705?fl=pl&fe=shSteve discussed the unusual activity in the restaurant sector - American Eagle, Sydney Sweeney & Email Discount Indexby Greg Robinhttps://vimeo.com/1116042295?fl=pl&fe=sh

Steve discusses how the Random Walk Promotional Ensemble improved after the Sydney Sweeney campaign.

- Systematic Scan of Millions of Emails to Detect Inflectionsby Greg Robin

- This week our system detected unusual activity in: CBRL, CRI, LEN, LULU, PZZA, SIG, ULTA, W

- Our process helps discover brands that are struggling to move product and resorting to changing keywords in campaigns

- Robust panel access helps reveal discounts sent to specific cohorts that are ‘invisible’ to coupon clippers on the sell-side

- 8 year history enables comparisons vs other outlier periods such as COVID

- Consumer Preferences are Shifting is Your Investment Process?by Greg Robin

FEBRUARY 13, 2025

Are your research dollars allocated to detecting real inflections or have your overspent on predicting the present?

> Explosion in alternative data has led increased precision in predicting KPIs such as current quarter revenues and same store sales.

> Sudden share revaluations in brands such as DASH, MTCH, BROS, SIG, MODG and PLAY indicate significant opportunities remain in detecting organic inflections.

Above: Predicting an uncertain future, not overfitting the present. You’ll eat in: DASH, Your wont drive: TSLA,UBER, You wont go anywhere: DKNG, META, AMZN Missing the Forest

The above advertisement from 1996 was prescient, but our promotional ensemble data can help investors better understand the tidal wave of changes that are occurring in real-time.

Institutional investors’ thirst for edge has led to overconsumption of complex ‘information’ that often misses the bigger shifts in preferences. Random Walk focuses on uncovering more actionable inflections based on changes in core demand for products and services through our Promotional Ensemble.

Stay Home and Swipe.Perhaps mostly driven by 5G and engineered addiction of smart phones consumers are moving away from activities popular in the past. Dating, courtship, buying engagement rings and the products of Signet and marriage appear to be substituted by ordering Wingstop delivery on DoorDash and betting on sports with Draftkings.

Getting together and going out for in person entertainment at Topgolf or Dave & Busters is being replaced by swiping through Insta.

Random Walk Promotional Ensemble

When brands are struggling to generate demand the easiest and most cost effective band-aid is to blast out email discounts. This is where the Random Walk process provides unique edge. We have been capturing, categorizing and classifying millions of email promotions from leading brands for more than 7 years. If decaying inventory isn’t moving quick enough, without spending much on advertising, brands just push out escalating discounts to leads. Conversely, when organic demand is growing brands slow email campaigns.

DraftKings (DKNG): New deposit confirmations explode higher as consumers stay home and bet on sports.

DoorDash (DASH): You’ll eat in. Doordash will bring food to you so you can stay inside. Our promotional ensemble indicates reduced incentives and email discounts as diners continue to grow rapidly.

TopGolf (MODG): Interest in going out to TopGolf and shanking balls is waning as our promotional ensemble detects rapid growth in game play related gift cards and discounts.

Dutch Brothers (BROS): Take it home no need for a cafe. Reduced promotional email volumes from Dutch Brothers - Alternative Data Podcast- Promotional Ensemble Historyby Greg Robin

Random Walk has been serving investors for 14 years. After years of focusing on clicksteam, foot traffic data and other online measurement, in 2017 we shifted to focusing on creating the most quantitatively accurate promotional ensemble in the industry. As others used tractional data to incorrectly assess demand in department stores such as JC Penny, our process alerted investors that these sales were just a result of liquidation coupons.

Listen to learn more about our methodology is different than other big data providers below:

Greg’s chat with Mark Fleming-Williams on Apple Podcasts

Below: skyrocketing steep discounts and a rise in the effective discount uncover the inflection.

Promotional Ensemble for JC Penny: 2017 Liquidation coupon explosion inconsistent with a rebound in organic demand.